Bishop Hill

Bishop Hill Ridley and Dyson on shale

May 4, 2011

May 4, 2011  Energy

Energy Matt Ridley has written a report on shale gas for GWPF. This is an excellent, even-handed look at the pros and cons of this new energy source.

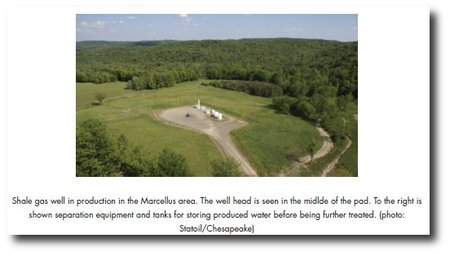

It's hard not to come away with the impression that shale gas is pretty benign compared to the alternatives. For example, the footprint of a shale well is amazingly small...

There is also a whimsical foreword from Freeman Dyson:

Two scenes from my middle-class childhood in England. In my home in Winchester, coming wet and cold into the nursery after the obligatory daily outing, I sit on the rug in front of the red glowing gas-stove and quickly get warm and dry. In the Albert Hall in London, in a posh seat in the front row of the balcony, I listen with my father to a concert and hear majestic music emerging out of yellow nothingness, seeing neither the orchestra nor the conductor, because the hall is filled with London‘s famous pea-soup fog. The gas-fire was the quick, clean and efficient way to warm our rooms in a damp climate. The fog was the result of a million opengrate coal fires heating rooms in other homes. In those days the gas was coal-gas, with a large fraction of poisonous carbon monoxide, manufactured locally in gas-works situated at the smelly and slummy east end of the town. Since those days, the open-grate coal fire was prohibited by law, and the coal-gas was replaced by cleaner and safer natural gas. London is no longer the place where your shirt-collar is black with soot at the end of each day. But I am left with the indelible impressions of childhood. Coal is a yellow foulness in the air. Gas is the soft purring of the fire in a cozy nursery.

In America when I raised my own children, two more scenes carried the same message. In America homes are centrally heated. Our first home was heated by coal. One night I was stoking the furnace when a rat scuttled out of a dark corner of the filthy coal-cellar, and I killed him with my coal-shovel. Our second home was heated by oil. One happy day, the oil-furnace was replaced by a gas-furnace and the mess of the oil was gone. We were then told that the supply of natural gas would last only thirty years. Now the thirty years are over, but shale gas has extended the supply to a couple of centuries. While the price of oil goes up and up, the price of gas goes down. In America, coal is a bloody fight in the dark. Gas is a clean cellar which became the kids‘ playroom.

The most important improvements of the human condition caused by new technologies are often unexpected before they happen and quickly forgotten afterwards. My grandmother was born around 1850 in the industrial West Riding of Yorkshire. She said that the really important change in working-class homes when she was young was the change from tallow candles to wax candles. With wax candles you could read comfortably at night. With tallow candles you could not. Compared with that, the later change from wax candles to electric light was not so important. According to my grandmother, wax candles did more than government schools to produce a literate working class.

Shale gas is like wax candles. It is not a perfect solution to our economic and environmental problems, but it is here when it is needed, and it makes an enormous difference to the human condition. Matt Ridley gives us a fair and even-handed account of the environmental costs and benefits of shale gas. The lessons to be learned are clear. The environmental costs of shale gas are much smaller than the environmental costs of coal. Because of shale gas, the air in Beijing will be cleaned up as the air in London was cleaned up sixty years ago. Because of shale gas, clean air will no longer be a luxury that only rich countries can afford. Because of shale gas, wealth and health will be distributed more equitably over the face of our planet.

Reader Comments (81)

Though from what I saw in gasland, it didn't seem all that benign. Of course, I have no idea if the shale-gas operations in gasland are usual or if the methods used are the industry standard.

From Freeman Dyson's Foreword:-

"Because of shale gas, wealth and health will be distributed more equitably over the face of our planet."

No wonder the Greenies hate it.

You are right on the button, Mr Brumby. The Greens are not interested in any betterment of Man's health or wellbeing, they are very bitter and determined control freaks who will not easily give up their sniff of power, which is, hopefully, receeding from their grasp.

@amabo

From the Ridley report:

I have not seen Gasland but from examples like this it seems to be another dodgy Hollywood polemic along AIT lines.

The biggest problem with shale is economics. In the US the shale producers are bleeding red ink and are telling shareholders that they are transitioning to shale liquids. The reason is the very poor energy return on the energy invested and the lack of equipment necessary to make the process work. Given the high depletion rates you need thousands of drill rigs working around the clock to keep production levels stable. That means that marginal producers wind up bidding against each other for equipment and rig crews and oil services prices are exploding at a time when the wellhead price is too low to justify taking the risks. Most of the producers are one dip away from bankruptcy. I do not see how producers in European or Asian countries can do better unless they happen to be in one of the few sweet spots in a shale formation. While those sweet spots can help individual companies they do not do much for the overall sector, which has to produce gas from low energy density rock.

Shale gas is not biogenic? Is this an established fact? Doesn't it count as a fossil fuel? Is it still forming, and if so at what rate?

Not only do the 'Greenies' hate it - the politicians hate it too - because it completely b*ggers up their plans to tax us to within an inch of our lives - for our own good, you understand - supporting uneconomic and visually offensive wind farms.

Freeman Dyson's introduction promotes a sincere concern for humankind, a practical appreciation of quality of life and welcomes progress that will benefit us all. This is unlike many environmentalists who, quite intentionally, exploit poor and distant people to excuse stealing from 'the rich' here.

A reminder about assumptions, a quick grab a link which will do as a starting point.

From 1995

http://articles.latimes.com/1995-08-18/news/mn-36334_1_most-mexico-city

Author Bill Bryson is living in a house built about the time Dyson's grandmother was born, and in his At Home writes of tallow and wax candles, and the transition to gas light and electricity. I am enjoying that book as much, for different reasons, as I enjoyed Montford's HSI.

@Vangel

From the Ridley report:

Why is it, I wonder, that certain commenters here are so very quick to discover the lead-lined coffin inside this particular cloud?

amabo

Who are you? Never heard of you here. Yet you pop up out of nowhere with the #1 comment on this thread.

And insinuatingly negative it is too.

Weird, isn't it?

And will "Amabo" be quickly followed by "Amabis" and Amabit", not to mention their plural relatives "amabimus", "amabitis" and "amabunt"? :-)

Here is an interesting further perspective on the environmental issues from one John Underwood of Fort Worth (hope he does not mind me quoting him): "Over the past 70 years something like 400,000 wells have been stimulated using hydraulic frac techniques. I doubt you can find 5 cases of contamination from a frac job. I just wish driving to work was so safe. No, there is no need for a moratorium, there is a need for good information to be seen by non-industry people."

Good to see Dr Ridley putting a balanced case, both more informed and more eloquent than I could have done!

Just think of the potential transformation of Southern Africa given the map. And it would help the UK too if the green nay sayers can be confronted.

While the report has some interesting viewpoints and information it hangs on the assumption in Paragraph 6.

As I showed with examples, in my review of the EIA Shale Gas Report , there are many cases which show that the decline rates in the first year are up to 85% and not the 25% cited.That difference makes a big change in the economics of the operation and makes it less credible that there are many companies which are able to profit while selling shale gas at below $4 per kcf. Since this is the price that LNG from places such as Qatar can be landed, it makes the overall economics of the process more questionable at the present time.

Incidentally also the percentage of the US shale gas resource that is considered a viable reserve is only around 6.9%.

And P.S. did you notice that, in the EIA Budget Cuts they have included:

Why is it, I wonder, that certain commenters here are so very quick to discover the lead-lined coffin inside this particular cloud?

Perhaps it has something with looking at things as they are rather than accepting narrative as fact. If you look at the shale gas producers you see a lot of red ink and negative cash flows. You listen to the conference calls and you find out that they can't get enough rigs to keep production from falling because the depletion rates are too high. The leading promoters of shale gas are now talking about a transition to shale liquids instead. All this gives up a great deal of information about the way things are, not what the EIA or IEA or promoters say they are.

With the change in government in Canada, we will shortly find out how viable shale gas/tar sands are.

If commercially viable, expect many countries currently dependent on importing energy to be self sufficient on fossil fuels, able to generate electricity, able to supply potable water etc.

Anyone with humanitarian concerns should welcome this possibility

That's funny, teamster Gavin Schmidt at Realbeta.org was warning about the horrid dangers of shale gas.

Gavin is now a shale gas extraction expert of course. Our Gavin the modern day Einstein. He just knows so much.

@BBD:

I comment every now and then here and there, pretty sure I've commented on stories here earlier. I don't really feel all that negative about gas, but if the extraction process negatively impacts watertables, wells and human health in general as severely as in the documentary then I don't have very high hopes that it can be an economical venture, since people will obviously start charging them (gas companies) more for drilling rights.

amabo

They don't. So why break your habitual silence to exhume anti-shale gas propaganda?

And I still don't recall ever seeing you as 'amabo'. Do you post here under other pseudonyms?

Vangel

Well, for now I'm happy to defer to the majority voice on this - and ignore your (US-based) anti-shale gas bias.

We will see how this works out on the global stage.

Heading Out

(from your blog):

I have a rule. When someone uses the phrase 'addiction to oil' I stop listening to what they have to say.

This is because the economic dependence on oil cannot, by any reasonable measure, be described as an addiction. Oil is a feedstock.

In what sense are cattle 'addicted' to grass? I hope you can see why I have a problem with this hackneyed and loaded terminology.

BTW, what does it matter if EIA stops monitoring US GHG emissions? CDIAC does that job.

BBD:

Actually it also appears that some of the CDIAC servers have gone down (see my first Arkansas post ). One of these days I am going to give them a call and find out what is going on.

Oh, and the "addiction to oil" phrase was used in this particular context, since it has been the catch phrase of US President for at least two decades. Yeah it's hackneyed, but sometimes even those phrases make a point. As in "you keep yacking that we have a problem, but here you're taking away one of the tools that is useful in trying to solve it."

This may be of interest.

http://www.archive.org/details/The_Facts_on_Fracking_by_Dr._Anthony_Ingraffea

Heading Out

You are dead right that government agency servers should not be down for any length of time. However, how does the presumably temporary unavailability of US surface station T data impinge on CDIAC's role in monitoring US (and global) GHG emissions? Forgive me if I am missing something obvious. It has been a long day.

As for the tired, irritating and bias-laden clichés relentlessly deployed by our political masters: my advice would be to avoid them. I appreciate your point, but the net effect on many readers may not be what you were aiming for.

Well, for now I'm happy to defer to the majority voice on this - and ignore your (US-based) anti-shale gas bias.

We will see how this works out on the global stage.

First, I do not believe that the majority voice is right because most in hat majority are too ignorant of the facts. (See the IPCC and the AGW scam to see what I mean.)

Second, I do not really have an issue with the contamination problem because if CBM can work out there is no reason for shale to have major problems.

My big problem is with the economics. Unlike many bleeding heart types I am interested in profiting from a venture that I invest in because it is viable. So far, shale gas has not been viable. The energy invested to produce, process, and distribute the gas is very close to the energy content of the gas. That limits profits substantially. But an even bigger problem is the complexity involved in planning the development of shale areas. To get a meaningful amount of production you need a lot of wells that are quite far apart. These wells deplete very rapidly, which means that you will have to drill two new wells next year for each three wells you drilled this year just to stay even. Of course, each of these wells will have to have its own distribution system that takes the produced gas to the main pipeline. The actual depreciation will be very rapid but the accounting rules may permit a slower write-down of assets. This means that investors who do not pay attention can be fooled by reports of false gains or lower than actual losses, which is why they need to pay attention to the actual cash flows, which are tougher to fake. In the end, shale gas is great for the landowners who collect lease payments and royalties, early speculators, and energy company management. But it is not very good for those looking for a sustainable business model and an investment that offers real solutions to real problems.

@BBD:

I broke my habitual silence, which is a strange way of saying "I commented" because the documentary left me with the impression that the problems described in it were presented as actual and widespread. (Ie, they're happening more then one or two places.)

I don't recall posting under some other pseudonym here. I can only say with certainty that I have commented in the past as 'amabo'.

amabo

It is exactly accurate, not 'strange'.

The 'documentary' was precisely designed to leave you with such an 'impression'. Why not do a little fact-checking? It passes the time.

Vangel

Fair enough. You may well be correct (argument is plausible and substantiated).

We shall see how it plays out in the mid- long-term.

Meanwhile, let's go absolutely hog wild and allow ourselves a tiny ray of optimism. For a change.

@BBD

Funnily enough I did decide to do that since there's not much else to do right now, and from what I've seen yes, these damages are taking place, and yes, it is likely that they are caused by hydraulic fracturing. Because of this I would personally not lease my property to a gas-company.

It is indeed a strange way to say it. I would personally never state "He commented" in such a way, when the words "He commented" serve far equally well and do not require me to guess at 'his' habits of either keeping silence or speaking.

I agree with Vangel and Heading Out that the market must be the arbiter, and not studies. Would that were the case for all energy markets!

I am struggling to recognise $4 as landed regassed Qatar LNG in the US - noone is trying to land at that price, and of those who might just turn a cent at that price, they do not include the Qataris. $4 means red ink for almost all LNG suppliers, and they are desperate to keep a link to Brent rather than NYMEX/Henry Hub. If shale gas production is really more than $4 then surely the import terminals would have been built and the proposal (that I know of) to convert one to export would not be under consideration. Nor would natural gas prices have been so depressed right across North America, leading to loss of volatility in both natural gas and power wholesale markets.

So my market experience, for now at least, is in line with Dr Ridley's analysis.

Heading Out has confused first year decline rates with first year production as a percent of ultimate recovery. A first year production of 25% of the ultimate recovery is completely consistent with a first year decline rate of 80% (from first day to 365th day), as the decline rate slows rapidly for the first few years.

@Heading Out

"Approximately 25% of a shale gas well‘s gas production emerges in the first year and 50% within four years" and "the decline rates in the first year are up to 85%." Rate and volume are two different things: any well can produce 25% of its ultimate recovery in the first year at 85% decline.

"Incidentally also the percentage of the US shale gas resource that is considered a viable reserve is only around 6.9%." Definition of "viable reserve?" Never heard of that reserve category, and "reserve" varies with commodity price. The molecule of gas that will be produced 200 years from now isn't currently a reserve but it is still a molecule.

"...selling shale gas at below $4 per kcf." Yes, that is what natural gas is selling for in the U.S. today. Extraordinary isn't it. And why is that? Perhaps because the industry has brought in an equally extraordinary rate of supply?

@Vangel

"...rig crews and oil services prices are exploding at a time when the wellhead price is too low to justify taking the risks." Yes, that is happening. All other things being equal, the operators would cancel their drilling programs. But other things are not equal. The companies will drill in this case because they need to hold the acreage they have leased, and they need to hold it because of the size of the resources and the economic benefit they will bring in the future.

"The leading promoters of shale gas are now talking about a transition to shale liquids instead." So what and why not? It is the same technology, fracs and all, in the same rocks, most often with significant associated gas, and an equally historic accomplishment for this industry.

"The energy invested to produce, process, and distribute the gas is very close to the energy content of the gas." You must be reading the ethanol pages on Wikipedia.

amabo

?sdrawkcab delleps amabo obama sI

Debunking Gasland:

http://www.energyindepth.org/2010/06/debunking-gasland/

@dreadnought:

.fotroS

@Don B:

Affirming Gasland:

http://1trickpony.cachefly.net/gas/pdf/Affirming_Gasland_Sept_2010.pdf

Meanwhile, let's go absolutely hog wild and allow ourselves a tiny ray of optimism. For a change.

I reserve my optimism for the idea that human beings are good problem solvers and will come up with solutions that will make life better if they are allowed to. But as a realist all I see are governments and special interest groups getting in the way. With so much of our scarce capital being diverted by governments to carpetbaggers in the wind, solar, biofuel, and other alternative energy sectors I fear that being reckless by ignoring the depletion curves or the net energy returns is foolish.

This does not mean that shale can't work. After all, shale rock has about the same energy density as a potato so any mechanism that can gather than energy could yield substantial amounts of useful hydrocarbons that we need. I just don't see a mechanism that can do that effectively enough to justify the costs and the risks at this point in time. At this point I would rather look at something like algae, methane hydrates, nuclear, or coal. There are also some promising hybrid systems where you may be able to use a very high efficiency gasoline or diesel fueled turbine to create power for electrical vehicles. The adaption of such systems could reduce fuel use by 50% per vehicle. Of course, none of us are smart enough to see the clear solution that will come eventually. This is why we need to let all those individuals seeking to get rich by coming up with solutions try to develop their ideas free from government meddling. Let the losers go broke and the winners get very rich. The sooner they come up with something viable the better off we will all be.

@Vangel

... and in a free market, one (or a combination of) the following will occur:

a) the price of gas will move towards that which clears the market

b) individuals (however organised) will enter or leave the industry/market.

@PetroGeoHouston

....All other things being equal, the operators would cancel their drilling programs. But other things are not equal. The companies will drill in this case because they need to hold the acreage they have leased, and they need to hold it because of the size of the resources and the economic benefit they will bring in the future.

I agree that many producers are drilling because they have to hold on to acreage. But they can only do that until they run out of money. Given the negative cash flows that might be a lot sooner than many think. But as you probably know there is another driver. By drilling the players can book proven reserves that can be sold to large oil producers looking to hide the problem that they are having with reserves. At the 6:1 ratio it may make sense for a big oil company like Exxon to purchase a shale producer and show stable or increasing total oil equivalent reserves even though many of the booked barrels equivalent come from uneconomic natural gas deposits that may never be profitable.

"The leading promoters of shale gas are now talking about a transition to shale liquids instead."

So what and why not? It is the same technology, fracs and all, in the same rocks, most often with significant associated gas, and an equally historic accomplishment for this industry.

I was just making the point that the natural gas operations are bleeding red ink and companies in need of cash are starting to look to the unproven promise of shale liquids as a way to attract new financing. Other than in some very good areas I doubt that shale liquids will be economic either. Even at these prices. Most shale oil wells produce less than 100 bpd but cost several million dollars. Depletion rates are steep. As with gas they make little economic sense right now.

@Vangel

My comment is, of course, a reply to the last paragraph of yours at 7:00 p.m.

Matt Ridley has won an award - the Hayek Prize.

amabo

Well done for making the effort. All you need do now is post the links.

Thanks.

Vangel

I agree with your comment at 8:08 PM. Spot on.

I published a paper in the French economic paper Les Echos titled 'Shale gas, a missed opportunity' :

http://lecercle.lesechos.fr/economie-societe/energies-environnement/221134593/gaz-schiste-opportunite-manquee

You may prefer a flavour in English, which you'll find :here :

http://www.nohotair.co.uk/2011/52-media/1901-shale-gas-a-wasted-opportunity.html

@Economist

.

.. and in a free market, one (or a combination of) the following will occur:

a) the price of gas will move towards that which clears the market

b) individuals (however organised) will enter or leave the industry/market.

The problem is that our markets are not very free. We see subsidies encouraging uneconomic activities and accounting rules fooling investors.

Vangel 9.06

Hear hear. Policy interventions and guesses at "externalities" are more about generating political, academic and bureaucratic jobs than delivering products and services economically.

amabo

Apologies - I missed your comment at 7:58pm.

May 4, 2011 at 7:53 PM | Dreadnought

llew dettops!

Shub

Yes! And isn't it encouraging that the irrational pessimist(s) are no longer topping the charts absolutely everywhere...