Bishop Hill

Bishop Hill Ridley and Dyson on shale

May 4, 2011

May 4, 2011  Energy

Energy Matt Ridley has written a report on shale gas for GWPF. This is an excellent, even-handed look at the pros and cons of this new energy source.

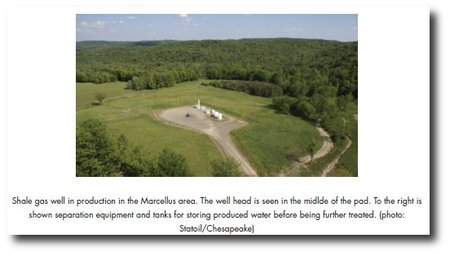

It's hard not to come away with the impression that shale gas is pretty benign compared to the alternatives. For example, the footprint of a shale well is amazingly small...

There is also a whimsical foreword from Freeman Dyson:

Two scenes from my middle-class childhood in England. In my home in Winchester, coming wet and cold into the nursery after the obligatory daily outing, I sit on the rug in front of the red glowing gas-stove and quickly get warm and dry. In the Albert Hall in London, in a posh seat in the front row of the balcony, I listen with my father to a concert and hear majestic music emerging out of yellow nothingness, seeing neither the orchestra nor the conductor, because the hall is filled with London‘s famous pea-soup fog. The gas-fire was the quick, clean and efficient way to warm our rooms in a damp climate. The fog was the result of a million opengrate coal fires heating rooms in other homes. In those days the gas was coal-gas, with a large fraction of poisonous carbon monoxide, manufactured locally in gas-works situated at the smelly and slummy east end of the town. Since those days, the open-grate coal fire was prohibited by law, and the coal-gas was replaced by cleaner and safer natural gas. London is no longer the place where your shirt-collar is black with soot at the end of each day. But I am left with the indelible impressions of childhood. Coal is a yellow foulness in the air. Gas is the soft purring of the fire in a cozy nursery.

In America when I raised my own children, two more scenes carried the same message. In America homes are centrally heated. Our first home was heated by coal. One night I was stoking the furnace when a rat scuttled out of a dark corner of the filthy coal-cellar, and I killed him with my coal-shovel. Our second home was heated by oil. One happy day, the oil-furnace was replaced by a gas-furnace and the mess of the oil was gone. We were then told that the supply of natural gas would last only thirty years. Now the thirty years are over, but shale gas has extended the supply to a couple of centuries. While the price of oil goes up and up, the price of gas goes down. In America, coal is a bloody fight in the dark. Gas is a clean cellar which became the kids‘ playroom.

The most important improvements of the human condition caused by new technologies are often unexpected before they happen and quickly forgotten afterwards. My grandmother was born around 1850 in the industrial West Riding of Yorkshire. She said that the really important change in working-class homes when she was young was the change from tallow candles to wax candles. With wax candles you could read comfortably at night. With tallow candles you could not. Compared with that, the later change from wax candles to electric light was not so important. According to my grandmother, wax candles did more than government schools to produce a literate working class.

Shale gas is like wax candles. It is not a perfect solution to our economic and environmental problems, but it is here when it is needed, and it makes an enormous difference to the human condition. Matt Ridley gives us a fair and even-handed account of the environmental costs and benefits of shale gas. The lessons to be learned are clear. The environmental costs of shale gas are much smaller than the environmental costs of coal. Because of shale gas, the air in Beijing will be cleaned up as the air in London was cleaned up sixty years ago. Because of shale gas, clean air will no longer be a luxury that only rich countries can afford. Because of shale gas, wealth and health will be distributed more equitably over the face of our planet.

Reader Comments (81)

I'm having a great deal of trouble reconciling two competing criticisms of fracking. The first, that it can and does contaminate underground water supplies, implies that the fracturing is so successful that it loosens things up for the thousands of feet up from the shale to the wells. The second is that the fracturing is so limited that it can only pull gas out from a very small region adjacent to the drill bore, and the well essentially fails within a few years. Which is it?

I am a geologist that works in the Marcellus Shale gas exploration business. I cannot speak for other places in the world, but here in the US it is mandated by virtually every state where such activities are occurring that when drilling reaches a depth (typically 500' - 1500') that is below known aquifers that provide drinking/potable water, the water will be isolated behind cemented in steel casing. At a deeper depth usually somewhere above where they begin to begin start turning the well to go horizontal they set what is called. an "intermediate" string of casing. This too is also cemented in place. Finally at the end of the well "production liner" is inserted and cemented in place.At each stage a pressure test in performed to ensure that the cement seal is doing it's job. All fracturing is done in the horizontal portion of the well. There is no reason at all for any contamination of drinking water to occur. I have not seen "Gasland". My suspicion is that the incidents shown in the movie occurred in the early stages of the development of the technology.

The technology keeps improving, the economics keep improving, and the market will find its level.

Gilbert K Arnold

Thank you for this clear account of the non-risk to groundwater from hydro-frakking shales.

I too believe that the incidents detailed in Gaslands were cherry-picked. But as I make plain above, I believe the film to be overt, anti-shale gas propaganda.

John Page

Absolutely. And this is what comes across from Matt Ridley's report. I also think that it's what Vangel believes, although he seems oddly ill-disposed towards the potential for improved EROEI over time (technology advance) steadily making shale gas a viable energy source.

@Curt

"I'm having a great deal of trouble reconciling two competing criticisms of fracking. The first, that it can and does contaminate underground water supplies, implies that the fracturing is so successful that it loosens things up for the thousands of feet up from the shale to the wells. The second is that the fracturing is so limited that it can only pull gas out from a very small region adjacent to the drill bore, and the well essentially fails within a few years. Which is it?"

I think that both are given by the critics at the same time but are not really contradictory. To start let us look at the first one.

I do not believe that the critics are suggesting that there is so much power used in the fracking that the process can impact rock thousands of feet above the site of injection. Their contamination arguments usually rest on one of two assumptions. The first assumption is that the fracking fluid escapes via faulty cement casings. The second is that the process may cause liquid to be lost to some natural fracture that may run a very long way. Both are very improbable but the second makes less sense than the first, which is very improbable given where the industry is as this time.

The second critique is valid. We do have data from various formations that shows very high depletion rates. This means that you need very high drilling activity just to stay even, which makes production levels difficult to maintain. The big problem here is the investment risk. Rigs can last a long time but given the nature of shale production no company wants to be stuck with too many of them and too many crews when production begins to decline and all that is left are the marginal parts of production to carry the day. This makes it difficult to get enough rigs built to satisfy the demand required to create a boom and we only see prices fall when producers decide to reduce their activity because they are not profitable. With relatively cheap LNG there as a competitor the ceiling for natural gas at this time is too low for most of the producers to make a profit.

I found the Ridley report a fascinating read and an excellent description of the PEST issues (the political, economic, social and technological) relevant to the development of shale gas. His comments on attitudes in Europe (including the UK) suggest to me that either it is necessary for the chumps in charge of energy policy to change their minds, or that the chumps themselves are changed, before we can get rid of distorting subsidies and tax regimes. And if Poland comes up trumps with the development of its basin, that could transform the prospects for that country.

@BBD

Absolutely. And this is what comes across from Matt Ridley's report. I also think that it's what Vangel believes, although he seems oddly ill-disposed towards the potential for improved EROEI over time (technology advance) steadily making shale gas a viable energy source.

I am not oddly disposed towards the potential for improved EROEI. I am simply pointing out that this is not a new technology that we are talking about. Horizontal drilling and fracking have been with us for quite some time and are fairly mature. While the process could get better still and improve it will have to be applied to more marginal areas because most of the sweet spots in American shale formations have already been drilled and foreign shale formation are still lacking necessary data. As Kenneth Deffeyes pointed out, shale rock has about the same energy density as a potato, which means that collection, concentration, and distribution will be expensive in monetary and energy investment terms.

Vangel

A couple of points arising from what you say:

From the Ridley report:

This is not, by any stretch of the imagination, a mature technology. To claim otherwise is, bluntly, misleading.

This is not, by any stretch of the imagination, a mature technology. To claim otherwise is, bluntly, misleading.

Changing the frack fluids and using different media to keep the pores open is not a big deal. The problem is still the same. You have a very low concentration of energy that has to be collected from a large basin using techniques that are very expensive and require a huge energy input. When you subtract the energy input from the output there isn't much room for error. Or for profit.

And when we talk about using the process to stimulate old conventional oil wells we are talking about something different than using it to get shale to produce oil or gas. The math does not work, which is why you are seeing the producers consume cash and capital. A much better play at this time are the low cost conventional players in the sector or coal. Or if you want risk look to the heavy oil producers or to the tar sands.

My apologies in the initial comment for misreading the report, which was caught by Don B and PetroGeoHouston, about what the 25% decline referred to.

Unfortunately it doesn't completely change my opinion. The reasons are several-fold and have to do with the path that the declining production follows (is it a logarithmic or exponential decay, for example, has been some of the technical discussion). There is also the problem, in highly impermeable shales, of long term pressure loss within the well that requires a compressor to bring the gas produced to delivery pipeline pressures That compressor comes at a cost, and the well must continue to make a lot more gas than covers that cost if it is to remain profitable. Those that don't get shut in, and we don't have enough experience of the long-term life of these wells yet to say when that will happen, but I have serious doubts that the survivors at that point will involve a high percentage of the total wells brought into production initially, particularly for those who expect that the wells will produce at an economic rate for 50 years.

Vangel: You do realize that it took Mitchell Energy 18 years to develop the techniques and the fluid dynamics too before they finally got economical production out of the Barnett Shale. We have only been doing horizontal fracking on a large scale for about 12 years. It has been known for a long time that there was gas in the Barnett, the Marcellus, the Fayetteville, the Woodford, and the Haynesworth.It wasn't until Mitchell Energy figured out the methodology and the fluid dynamics and the co-incident development of MWD (measurement while drilling) technology, steerable down-hole mud driven motors, and the computer programs to allow "real time" geo-steering of the wells that this became possible and economical.

Gilbert K Arnold wrote:

You do realize that it took Mitchell Energy 18 years to develop the techniques and the fluid dynamics too before they finally got economical production out of the Barnett Shale. We have only been doing horizontal fracking on a large scale for about 12 years. It has been known for a long time that there was gas in the Barnett, the Marcellus, the Fayetteville, the Woodford, and the Haynesworth.It wasn't until Mitchell Energy figured out the methodology and the fluid dynamics and the co-incident development of MWD (measurement while drilling) technology, steerable down-hole mud driven motors, and the computer programs to allow "real time" geo-steering of the wells that this became possible and economical.

The primary source of information that I use to reach my conclusions comes from the shale gas producers and the work of analysts. The producers are cash flow negative and (given the depletion rates and reasonable ultimate recovery estimates) need a price of $6.50 to $8.50 in order to turn a real profit. While some producers were able to get those prices because of hedging programs they no longer have that option given the current price levels for natural gas. When I see the prophet of shale gas, Aubrey McClendon, announce that Chesapeake is converting itself from a shale gas to an oil company the alarm bells should start to ring for all those who bought into the hype.

The bottom line is that until I start to see positive cash flows from operations I will treat shale gas as just another potential source of abundant and cheap energy that will be developed some time in the future. The problem with that view, of course, is that shale has always been a potential source of abundant and cheap energy that will be developed some time in the future. Remember Wyatt Oil in Atlas Shrugged? Getting oil from shale has been a dream for a long period of time. But somehow, its time has yet to come.

Vangel: Would you be willing to cite some of those reports and what analysts made those assertions? Until you do, I must regard your comments as hearsay.

@ Vangel:

Oil from shale huh? We are are talking about recovering Natural Gas, which is a horse of an entirely different color.

Regarding Chesapeake: Chesapeake is transitioning from an "asset gatherer" to an "asset harvester" position.They are not becoming an "oil" company. They have always been an oil producing company, they are now focusing on managing their assets to provide continued return on investment.

And your assertion that companies are swimming in 'red ink" may be a little bit of hyperbole. The Barnett Shale is currently providing approx 6% of all natural gas production in the US. Me thinks this is a very profitable endeavor.

Gilbert K Arnold

Thank you for continuing to follow up on Vangel's comments. I am not knowledgeable enough by any means on the shale gas debate, and always on the look-out for informed opinion.

This is particularly true if it runs contra the nay-saying by a small but vocal minority of energy experts.

I have a strong but unverified suspicion that there is a direct link between the belief in Peak Doom and the 'shale gas is a dead-end' meme.

Still gathering evidence at this stage.

Regarding Chesapeake: Chesapeake is transitioning from an "asset gatherer" to an "asset harvester" position.They are not becoming an "oil" company. They have always been an oil producing company, they are now focusing on managing their assets to provide continued return on investment.

Good old Aubrey was hyping up natural gas from shale for quite some time and telling us how his company would be very profitable and provide a great return for shareholders. That was fine when natural gas prices were higher than the production cost and hedging programs could reduce the risks. But now that prices are way below his $7.50 to $8.50 cost of production Aubrey is talking about reducing shale gas drilling and trying to go to shale oil. But, as Berman pointed out, the cash flows tell us what we need to know. The company is in big trouble because of its emphasis on money losing shale gas production.

And note that the argument is no longer focused on profits but production. As Berman pointed out, the interest is in the size of reserves, and the production growth because that is what the market is rewarding. The problem for producers like Chesapeake is that their production is creating a surplus that is causing prices to collapse and with that is killing their profits. And in the long run the market will value the producers on their profits.

And your assertion that companies are swimming in 'red ink" may be a little bit of hyperbole. The Barnett Shale is currently providing approx 6% of all natural gas production in the US. Me thinks this is a very profitable endeavor.

Check the 10-K filings with the SEC. It is not a profitable endeavor. High production and reserves do not generate profits but can be used as the basis of selling properties to conventional producers needing to show that their reserves are not falling. It makes sense for Exxon to play games by buying shale producers and book reserves because it has profits from other activities to mask the losses from shale gas production. The only danger would come from a change in SEC rules that might require a more realistic assessment of reserve booking but the odds of that happening are low.

The bottom line is that the producers are not making money. Many of them show capital expenditures running at several hundred percent of cash flow. Most of them have little in the way of shareholder value with their asset value being lower than their debt. If there is another dip in the works or QE2 is ended without a replacement in the works about half the producers could be looking at bankruptcy.

I have a strong but unverified suspicion that there is a direct link between the belief in Peak Doom and the 'shale gas is a dead-end' meme.

Suspicion and $5 will get you a latte at Starbucks. To find out what you need to know all you have to do is look at the SEC filings for the producers. Take a look at cash flow and see how many pure shale gas players show a positive value.

Confirm your position re peak oil.

If as Vangel says $6.50 to $8.50 is the real economics, then that is pretty good given LNG prices outside north America. I could live with a shale gas boom at those higher prices.

If as Vangel says $6.50 to $8.50 is the real economics, then that is pretty good given LNG prices outside north America. I could live with a shale gas boom at those higher prices.

As usual, things are not that simple. The decline rates ensure that there can't be a 'boom' at all. To keep production growing you need to replace each depleted well and drill new ones. That means more and more rigs need to be made and more crews need to be trained. The problem is that given the supply chain issues such a spike in demand will cause prices to go up above the $6.50 to $8.50 figure unless there are huge gains in productivity for the sector.

Aubrey McClendon is and has always been more of a promoter than a "hands on" operator. He is a bit of a riverboat gambler ( as long as it's "other people's money" and not his ). Chesapeake has monetized a not-insubstantial portion of it shale gas properties by selling interests. I suspect the company long ago recovered most ( if not all ) of its "at risk" capital.

At these gas prices ( ~ $4.00-4.50/mcf Henry Hub ) producers are either losing money or simply recycling capital. There's a fair amount of drilling going on that is only occurring in order to hold on to leases. Nobody is making any significant dough ( other than the investment banking M&A parasites and the property flippers now offloading on to the big companies who missed the initial land rush ).

The current glut of production was stimulated by the comparatively high gas prices witnessed from 2003-2008:

http://alfred.stlouisfed.org/graph/?g=qF

Vangel (May 4, 2011 at 7:00 PM) writes:

"To get a meaningful amount of production you need a lot of wells that are quite far apart."

Not neccesarilly so. That may be true in other parts of the world but in the Macrellus Shale, it not uncommon to drill from 3 - 11 wells on one drill pad. The lateral segments of these wells are typically 300'-500' apart. Thanks to advances in drilling technologies e.g.: geosteerring it is possible to drill these wells when their surface location is only 15'-20' apart. I was on one location where we drilled nine well;. 5 to the SE, and 4 to the NW. The reason for this is simple economics. It takes very little time to move a rig 15-20ft versus having to build a new pad and move all the equipment to it. On these pads, much of the surface equipment (mud pits, electrical plant, mud pumps, etc) does not have to move. this is a significant cost saving is the drilling of these wells.

Not neccesarilly so. That may be true in other parts of the world but in the Macrellus Shale, it not uncommon to drill from 3 - 11 wells on one drill pad.

I was not talking about the pads. I am talking about having to place the pipes far apart so that the fracking process for one does not scavenge from another. And as I keep saying my point always comes down to economics. For something to be sustainable it has to be economic. In this case we know that for the producers to make money they need $6.50 to $8.50 gas, a price that is far higher than current levels. And the real enemy is depletion. With most wells losing most of their initial production within a year the amount of drilling just to keep production flat is incredible. While that may help the oil services sector it does nothing but damage to producers.

Vangel: I am beginning to think you have no knowledge of the operating side of this business. They space the lateral wells 500-700' apart to give them the opportunity to go back in and re-frack the wells at a later date to re-stimulate the production. Keep in mind that on these pads that have from 3-11 lateral wells they produce them as a unit, not as single wells.If they have to re-frack the wells the capital cost is much less since all the infrastructure is already installed. There is no associated drilling cost. Now granted the re-fracked wells will not produce as much as the original production rate but it will be close to the original production.

Vangel: I am beginning to think you have no knowledge of the operating side of this business. They space the lateral wells 500-700' apart to give them the opportunity to go back in and re-frack the wells at a later date to re-stimulate the production. Keep in mind that on these pads that have from 3-11 lateral wells they produce them as a unit, not as single wells.If they have to re-frack the wells the capital cost is much less since all the infrastructure is already installed. There is no associated drilling cost. Now granted the re-fracked wells will not produce as much as the original production rate but it will be close to the original production.

Sorry that I was not very clear. Let me go over some of the basics that you are aware of but others here might miss.

First, the problem with shale comes down to porosity and permeability.

As you know porosity is just a measure of how much of a rock is made up of voids. (The ratio of the volume of voids to the total volume of material. ) These voids can be in the form of spaces between grains or within fractures in the rock. As you also know permeability is a measure of how well connected the voids are, or how easily the natural gas or oil can move within the porous rock. Shale can have high porosity but it is almost impermeable because the voids are not well connected. This is where fracking comes in.

In a typical conventional deposit you can drill the wells very far apart because the high permeability will allow the hydrocarbons to migrate to the pipe. This allows a huge return on the energy invested because you do not need to build as much collection infrastructure. But that is not true for shale. With shale you have a problem because you need to have the wells close together in order to collect as much of the gas or oil that is contained in the pores. The problem is that you can't drill the wells too close together because your returns will decline as wells begin to scavenge from each other. So what you are left with are operational decisions that choose between leaving uncollected hydrocarbons in inaccessible spots in a formation or higher collection percentages that come with unnecessary costs.

And all those drill pads, access roads, and collection networks do have a significant impact on both the total CO2 produced by the process, which is what the AGW alarmists claim to be concerned with, and the total return, which is what I am concerned with. On this front the data so far is very clear. The producers hyped up the shale potential and went after the easy pickings in the most promising structures. While it was possible to make a profit when gas prices were high and hedging was possible that is no longer the case. A bigger problem was the choice made by these players to undertake activities that are the mining industry's equivalent of high grading. By picking the lowest hanging fruit to be harvested first, the industry has ensured that future production will be harder and more expensive.

We already know that shale gas requires very high-cost wells that require a lot of water and energy input. This would not be a problem if they did not deplete so rapidly or if the use of toxic fluids did not raise questions about the contamination of groundwater or the disposal of harmful fluids produced by the process.

From what I can tell the shale gas hype is preventing action where improvements are much more likely to yield better energy returns and cleaner energy generation. Given the age of most coal and nuclear generation plants a simple way to improve efficiency and reduce pollution would be to allow the construction of new plants that conform to modern designs. It is a shame that so many people are grasping at straws and ignoring the financial and operational realities in the shale gas sector. If the US suffers another setback and we see a resumption of an economic decline many of the shale gas players will wind up in bankruptcy court or see their assets sold off to bigger players at pennies on the current valuation dollar. Until you can show me real returns I will remain a skeptic.

If you want to convince me you have to provide an argument against the following points.

The US hit its natural gas production peak at approximately 22 tcf in the early 1970s. It has yet to get back to that level even though new production came from the outer continental shelf, coal bed methane, and other sources.

Not long ago brokers were pushing me to get in on the next great boom, coalbed methane. But CBM production is now in decline as the easy production from the early targets is falling faster than new production from deposits that are harder to develop. If the EIA and promoters were so wrong about CBM why should I buy similarly optimistic hype for shale?

If you have been paying attention to the conference calls and the reports you will know that Chesapeake Energy has come up with data that shows that about half of American gas production comes from wells that were drilled in the past three years. (It is worse for the percentage of gas production coming from shale, where depletion rates are much higher.) This means that to keep gas production from falling we have to have a very high rate of drilling. But how can that happen when cash flows from operations are negative?

And let us go back to the Aubrey McClendon admission that Chesapeake needs a $4.00/kcf Henry Hub price to make enough money to cover the costs of a good well. (That means that consumers pay around $7/kcf.) With depletion rates running much higher than expected and the actual data showing the EUR of Chesapeake wells running at a paltry 1.2 Bcf/well versus the expected 6.5-7.5 Bcf/well and we can see why the company is now hyping shale liquids.

From what I see the big problem is debt. The shale operators used the hype to attract a lot of financing and used the cash to drill uneconomic wells that will lose money. That makes the shale players very vulnerable to the availability of financing and any setback could bring them to the brink.

Vangel and Gilbert K Arnold

Thanks for continuing to post. You have an audience of at least one ;-)

The exchange is very informative too, for which I am grateful.

Vangel: I may have done you a disservice. You appear to be nothing more than a well-informed and honest capitalist ;-) who likes to watch one dollar become two. And I have no quarrel with that. However, it is interesting that Gilbert K Arnold (who is clearly at the sharp end) simply doesn't agree with your analysis. I am in no position to judge who is right (perhaps you both are to an extent), so that's it from me.

Back to silent running ;-)

Vangel: I may have done you a disservice. You appear to be nothing more than a well-informed and honest capitalist ;-) who likes to watch one dollar become two. And I have no quarrel with that. However, it is interesting that Gilbert K Arnold (who is clearly at the sharp end) simply doesn't agree with your analysis. I am in no position to judge who is right (perhaps you both are to an extent), so that's it from me.

Note that I do not disagree with the technical points brought up. We can use horizontal drilling and fracking to develop shale reserves. You do use pads to drill wells that are much closer together than conventional wells but not too close that they scavenge from each other. The wells are very expensive and in some areas can run upwards of $10 million. Depletion rates are very high, which means that in order to keep production level we need a huge supply of new rigs and manpower.

My problem is with the predictions and the interpretation of the data. I maintain that the shale drillers have gone on the record and made claims that are no longer supportable by the empirical evidence. Until that changes and they start showing positive cash flows there is a credibility problem that can't be solved by spin and narratives.

I have to go now. My son wants access to the Mac so that he can play his silly games.

Vangel

Apologies. My last was not well written. No snark intended at all. I was trying to acknowledge that you know the numbers and respond rationally. And I have no quarrel with that.

On re-reading what I wrote, I feel the need to clarify.

Your patience and careful analysis are both equally appreciated.

On re-reading what I wrote, I feel the need to clarify.

Actually, there was no need at all. I thought that you made your point well and appreciate the fact that someone is actually trying to look at the numbers rather than react emotionally or by cherry picking as many in the AGW camp do when I bring up numbers that they do not like. My experience so far has been to trust the numbers. In the case of shale the numbers do not match up well to the narrative. And as much as I would like to find a 'solution' to our problems I do not see shale as measuring up at this point in time. I still think that the hype about shale keeps us from making the hard decisions that we need to so that we can build the new coal and nuclear facilities in time to prevent a massive economic problem further down the road.

Vangel: In general I agree with your points about the need to develop more efficient coal plants and more modern nuclear plants. We both know that both of those options are anathema to the "green" faction, but it is almost imperative that we go down that path and use the natural gas that we are developing today in the shale gas plays as chemical feed stock rather than for heating, power generation, or automotive use.

Re: depletion/decline rates we only have the Barnett field as a guide to what those rates may be. It is possible that the Marcellus, Fayetteville and other shale plays could be different. I'm glad to see that you understand the difference between a "conventional " oil/gas system and an 'unconventional" reservoir. Already in some mature oil fields they are doing what is called "Enhanced Oil Recovery" (EOR). The methods they use for EOR depend on whether the original production is a gas-drive or water-drive reservoir. In the first case the gas trapped against the cap rock provides the pressure to force the oil to the surface. In the latter case the water below the oil/water interface provides the pressure.to push the oil to the surface.In both conventional and unconventional reservoirs there is a certain irreducible oil saturation that limits what you can get out of the ground. You can never get all the oil or gas out of a reservoir.How much you want to spend will determine how much you will ultimately recover.

Costs for drilling and completing shale gas wells (as far as I have been able to determine) run about 3-3.5 Mil dollars. The actual length of these wells ranges from 7000-13000' measured depth. The true vertical depth is usually about 5000'-7000'.Also keep in mind that you have a nearly !00% success rate in shale gas wells, versus about 30% success rate in conventional wells.

In the long run I think we will just have to agree to disagree on the profitability of the shale gas production.

Re: depletion/decline rates we only have the Barnett field as a guide to what those rates may be. It is possible that the Marcellus, Fayetteville and other shale plays could be different.

From the material that I have read and the conference call information that I have looked at I do not believe that this is the case. As I pointed out before, many of the initial players are trying to remake themselves as shale liquids plays because they can't make money by producing shale gas.

I'm glad to see that you understand the difference between a "conventional " oil/gas system and an 'unconventional" reservoir.

As in investor in the sector I better understand. Otherwise I would make very stupid mistakes that would lead to losses in the long term. While there is money to be made from speculative bubbles where people rush into unprofitable activities it is hard to make money over the long term by playing the momentum game and by not looking at the fundamentals.

Already in some mature oil fields they are doing what is called "Enhanced Oil Recovery" (EOR). The methods they use for EOR depend on whether the original production is a gas-drive or water-drive reservoir. In the first case the gas trapped against the cap rock provides the pressure to force the oil to the surface. In the latter case the water below the oil/water interface provides the pressure.to push the oil to the surface.In both conventional and unconventional reservoirs there is a certain irreducible oil saturation that limits what you can get out of the ground. You can never get all the oil or gas out of a reservoir. How much you want to spend will determine how much you will ultimately recover.

It is ironic that what you are pinning some of your hopes on is likely to bring us a crisis sooner than expected. Yes, you can get more oil out of old fields by using enhanced recovery techniques. But the problem is that after all production has taken place the use of such techniques are just as likely to trap oil behind the drive as it is to get more oil out.

Remember Yibal, Oman's largest oil field? The use of modern techniques did not produce more oil.

The PEMEX experience with Cantarell is very instructive of how gas floods work. While Cantarell's production was increased by the injection of nitrogen the 'fix' only ensured that the back end of the production curve dropped much faster. After seeing production increasing to 2.1 mbpd due to the use of enhanced recovery techniques, PEMEX witnessed a collapse that it could do nothing about. We now have production down by two thirds with little sign of stabilization. It won't be long until Mexico is a net importer, just like former oil exporter Indonesia. Sweeps have also been used in Burgan, Daqing, and Ghawar and are now in decline.

Costs for drilling and completing shale gas wells (as far as I have been able to determine) run about 3-3.5 Mil dollars. The actual length of these wells ranges from 7000-13000' measured depth. The true vertical depth is usually about 5000'-7000'.Also keep in mind that you have a nearly !00% success rate in shale gas wells, versus about 30% success rate in conventional wells.

I have seen cost estimates of $5 to $10 million for some formations. I believe that some of the papers and commentary that I cited included that range. The latest QEP Resources conference call had average well completion costs at $9.1 million, three times higher than your number. Oil services companies are reporting high costs for various formations where they have to go deep and have less than ideal conditions. They have certainly reported better results as their rigs are busy and they have been able to charge higher prices per day. While there have been productivity improvements that helped to reduce the number of days it took to complete a well the costs are still higher for most companies. I don't know about you but I do not see a mania that would have a lot of new equipment come on-line. The drillers are not over-investing because they are worried about creating a glut that would lower costs for their customers.

In the long run I think we will just have to agree to disagree on the profitability of the shale gas production.

I think that our opinions do not matter. The market will tell us what we need to know. Keep your eye on the shale producers and see how much positive cash flow they can generate.