Bishop Hill

Bishop Hill Libertarians do carbon taxes

Jun 3, 2012

Jun 3, 2012  Climate: other

Climate: other  Economics

Economics  Libertarianism

Libertarianism  Tax

Tax There are two interesting posts advocating carbon taxes doing the rounds at the moment. These have been getting quite a lot of attention because they have been written by libertarians rather than the millenarian hippies and the retired Socialist Worker salesmen who usually promote the idea. I shall hazard a comment on these economic issues, issuing my customary caveat that economics is not really my thing.

First up is Jonathan Adler, who normally blogs at US law blog, the Volokh Conspiracy, but has chosen to set out his ideas at Megan McArdle's blog:

It is a well established principle in the Anglo-American legal tradition that one does not have the right to use one's own property in a manner that causes harm to one's neighbor. There are common law cases going back 400 years establishing this principle and international law has long embraced a similar norm. As I argued at length in this paper, if we accept this principle, even non-catastrophic warming should be a serious concern, as even non-catastrophic warming will produce the sorts of consequences that have long been recognized as property rights violations, such as the flooding of the land of others.

The other is by Tim Worstall, here at the Telegraph blog:

So this is what we know about climate change. We know there will be some effect from emissions, and we also are uncertain about what that effect will be. The uncertainty itself means that we should do something. But what?

I've already explained this here. Don't listen to the ignorant hippies to our Left, or to those shouting that there's nothing to it from the Right. The answer is, quite simply, a revenue-neutral carbon tax.

The idea of a revenue-neutral carbon tax, with the proceeds distributed on a per-capita basis is enticing, to the extent that it is less obviously corrupt than all the other measures that are currently in place. And as Tim Worstall points out, the cost of all these other measures is in the UK is already in excess of what a carbon tax based on a sensible estimate of the cost of carbon is. The introduction of the tax would therefore presumably not only lead to the demise of the renewables obligations and subsidies to windfarms and the like (pull the other one, I hear you say) but would also bring about a rise in other taxes to make up the shortfall.

The real cost of carbon or the cost that is good for us?

The carbon tax as envisaged by most of its proponents would involve taxing carbon as it was extracted from the ground as oil or gas, and returning the proceeds on a per-capita basis. In essence we have a exercise in redistribution from heavy carbon users (the rich) to light carbon users (the poor). The amount of this redistribution is therefore a direct function of the cost of carbon; redistribution from rich to poor becomes not a question of morals but of climate science.

Which would be pretty strange.

Although Timmy suggests that the figures involved are relatively small ($80/t CO2 on Stern's estimate), readers here know that estimates for the cost of carbon range as high as the $1000/t or more put forward by Ackerman. At that level, American redistribution via the carbon tax would be $18000 per capita per annum. We could call it carbon communism.

But wait a minute, I hear you say, Ackerman's figure is insane - and indeed it is. However, we have seen the figure touted by establishment figures in the UK, and Ackerman is a co-author on James Hansen's upcoming paper. What you or I might think of as mad and without any basis in reality is accepted as sound by any number of people in positions of influence. Stern's figure seems dubious to many people too. It is well known that his estimate involved all sorts of jiggery-pokery, with discount rates picked to give the answer that he felt was "moral".

How then can members of the public be sure that the figure arrived at is an estimate of the true cost of carbon rather than a reflection of what a bunch of millenarian greens in the academic firmament feel is good for us? The answer is, we can't. Right along the chain from climate model to carbon cost estimate society would rely on academics who have shown themselves to be utterly unscientific and devoid of any integrity and a process that is so corrupted by political activism as to make it meaningless for policy purposes. We cannot hand over control of part of the taxation system to people like this without means to enforce professional behaviour and to ensure the process is unbiased.

The problem is that the corruption of science now runs so deep that I fear it is beyond repair. In climatology, where materials and methods are routinely kept secret, where journal gatekeeping goes unremarked, and where the funding streams are directed by environmentalists and millenarians, there is little hope of ever actually achieving an estimate of the cost of carbon that is not distorted to the point of meaninglessness.

Who am I hurting?

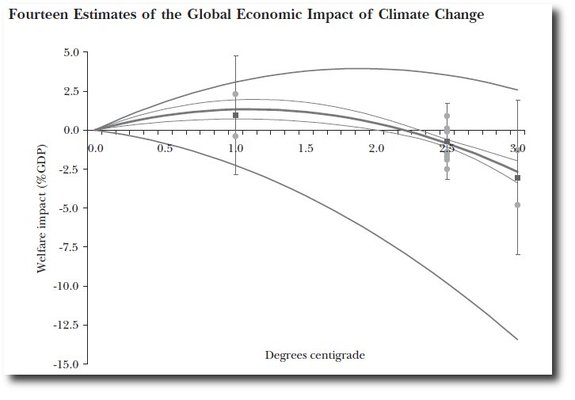

Here's another issue. The economists' estimates try to put a cost on carbon emissions that captures all the costs and benefits forever (discounting future costs and benefits in some way). However, economists also agree that the effects of global warming are likely to be positive for warming of up to 2°C above current levels.

As the chart shows, there are two estimates for the effect of relatively small warming - one positive and one negative, but Tol, from whom the graph is sourced, tweeted the other day that the author of the study predicting negative consequences has since changed his mind, so it appears that there is now a consensus (of sorts) that small warming will have beneficial effects for mankind (but see all the caveats above about whether we should believe any estimate based on climate science).

Think about the implications of this. If we are to believe the IPCC's central estimate of future warming of 2°C/century, then for the next hundred years - which is to say at least for the rest of my lifetime - I am on average increasing the value of my neighbour's property, not damaging it. I'm not sure I can accept being punished with a carbon tax for doing this.

So what am I saying?

A revenue neutral carbon tax is, on the face of it, a better policy instrument than anything tried so far. The problem is that it will almost certainly not be revenue neutral and it will probably reflect an millenarian view of the cost of carbon. It is therefore hard to say for certain if it will be any sort of an improvement on the shambles we have now.

Reader Comments (101)

How does all this square with the apparent absence of warming for the past decade or more? I remember some years back some public relations firm in the UK advising the city of London on how best to communicate the imminent horrors of climate doom recommended that the people selling the concept act as though the science was settled. In other words, you pretend that the science is settled, even if you don't believe it deep down. You saw it in the recent comments of Myles Allen and Chris Colose both here and at Climate Audit. They speak as if the science is actually settled and they know that the climate is only going to get warmer. I don't know that that is true.

I think it's worthwhile to talk about these things, but the caveat cannot be repeated often enough that until we have some idea where the climate is actually heading we are just living in a world of fantasy.

Another problem is that there is no legitimate way to trace any damage done to one person's property directly to some arbitrary carbon emission by another. The "case law" cited in the beginning of the article (without any actual references) always refers to some directly attributable cause. This cannot be said regarding CO2. We cannot even say for sure that it is having any discernable impact whatsoever. The libertarian needs to screw his head on.

Mark

Mark T

I was going to make this point, but ran out of steam rather. Mill's harm principle requires the damage to be direct IIRC.

"A revenue neutral carbon tax is, on the face of it, a better policy instrument than anything tried so far."

No, it is the best, the final, the perfect answer.

"The problem is that it will almost certainly not be revenue neutral"

The political temptation is most certainly that it will not be. But we do, in the end, control them, right?

"and it will probably reflect an millenarian view of the cost of carbon."

And so the battle should be, not this "it ain't happening" but rather "if it is, so, here's the solution".

The loons can only get away with lunacy if the sensible aren't even taking part in the decision making...

I like Mckitrick's carbon tax idea. This is a tax, based on mid-tropospheric temperature. As temps go up, or down, the tax follows.

At Ross's site, about 1/2 way down, is his idea for a T3 tax.

Note that if temps fall enough, it would become a subsidy....

http://sites.google.com/site/rossmckitrick/#t3tax

Tim

It's only perfect if it's perfect. If Ackerman is setting the tax levels it's not perfect.

So, don't tax me, sue me. See you in court. Don't bring AR5 and say it is evidence if you are not ready for discovery.

How was taxing going to reduce the 'harm' anyway? What about the air force? Will they be paying tax to reduce harm? To whom? This is silly. No libertarian wrote this.

Tim, this is called the "husband's dilemma". Your wife is planning to buy something stupid like an electric foot spa. Do you tell her not to buy the stupid thing or do you go to the shop with her and try to ensure she buys the least stupid option (eg get the foot spa on 6 months approval).

In a marriage you have to do what it takes to get along - even if this means sometimes humouring people.

A nation does not have to work like that - why should we humour the greenies?

I feel I must have missed something here.

If the object is to, on average, leave evryone as well off as they are now (revenue neutral) and to charge heavy users of carbon more than light users why not just leave things as they are and do not introduce any new taxes because that is the system we have now?

Carbon taxes are like other taxes: You need keep an eye on your politicians.

One of the good things about environmental taxes, compared to other forms of environmental policy, is that it necessary involves parts of the government bureaucracy that tend to care more about the economic consequences than environmental regulators do.

" We know there will be some effect from emissions, and we also are uncertain about what that effect will be. The uncertainty itself means that we should do something"

On the contrary.

Nothing should be 'done' until the 'problem' is identified.

Richard

Could one turn that around and say that carbon taxes are worse than other taxes because they involve parts of the bureaucracy that don't give two hoots about the economic consequences?

graphicconception,

Revenue neutral means that all the money taken in emissions taxes (less admin costs...) is distributed to the public - so it isn't a revenue raiser for other political aims. Those who emit loads would pay more than they get back and those who emit the least would get more than they paid.

I for one would go further. If the government is serious that climate change is a threat then emissions taxes should be at the expense of a portion of existing taxes not in addition to them. The cost should not just be to us in money but to them in politically motivated spending as well.

I have written about Worstall's ideas. He doesn't have any response.

For all his excellent ideas, their basis lies in accepting not only the IPCC prognostications but a worldview dictated by the precautionary principle. Worstall is either incapable of, or somewhat reluctant to admitting to the above. But at the same time, he likes to pretend that his mind-numbingingly simple solutions are unacceptable to sceptics arising from their sheer stupidity.

Message to Worstall: Never accept something that you lack the capacity to reject.

I offer myself as the manager of a 'revenue neutral' carbon tax. I hereby guarantee that I will redistribute all the tax income less my management expenses which will be 50% of the tax collected.

Problem solved.

On a carbon tax of "$80/t CO2": This translates to $250/t on coal and crude.

I would say that the minimum to reduce fossil fuel usage, in fact it would eliminate coal entirely. It works out to $0.20 for diesel, even less for an equivalent amount of natural gas. As road taxes are already higher in most of the world, they could be reduced a bit. I don't know what hit it would have on electricity from gas.

Les Johnson says- "I like Mckitrick's carbon tax idea. This is a tax, based on mid-tropospheric temperature. As temps go up, or down, the tax follows."

Me too.

The trick with any tax-based solution is where to set the tax so that it impacts behavior. Otherwise it is yet another execrable circle-jerk.

Consider gasoline. To reduce gasoline consumption in the US to European per capita rates, for example, will require at least a $4/gallon fine, in line with what Energy Secretary Chu has long advocated. EPA states that 1 gallon of gas produces up to 0.0089 tons of CO2. A minimum of $450/ton CO2 tax is necessary to reduce transportation CO2 emissions in the US.

A 'revenue-neutral tax' is an oxymoron. I conservatively estimate that 30% of CO2 confiscatory taxes will be 'lost' to bureaucratic entropy.

@Bishop Hill

Fair enough.

But if we must have climate policy -- and the majority of voters and the vast majority of the powers that be think we must -- then a carbon tax is far superior to the ragtag of policy interventions that we now see across Europe.

The prospect of a 'carbon tax' is presumably something the tryants-in-waiting at the UN are salivating over.

Lubos Motl has on his blog an analysis that a low carbon tax of below $100 a ton I think, would have little impact on end prices. Therefore $1000 a ton is more likely if you want to change behavior rather than gain revenue, which I think is the true goal.

On the other hand, a carbon tax that is limited to a few countries accomplishes nothing. How do you get China and India to sign on to a high carbon tax?

Anyone tempted to consider the implementation of a "carbon tax" as a solution to the global warming problem will have the Australian experiment running from the end of next month to analyse for efficacy. Only a terminally stupid populace elsewhere would stand still for the introduction of such a tax until that Australian experiment has been running for several years (at an introductory rate of $AU23 a metric tonne) and until the effects of that tax are apparent.

Unless the de facto centre-left Labor-Green coalition Government is defeated in the federal election next year, and unless the incoming centre-right Liberal-National coalition government honours the current leader's promise immediately to abolish the tax, it will run for three years before morphing into a cap and trade scheme. My cynicism is such that I do not believe that any politician of any political persuasion will forgo a virtually bottomless pit of new taxation revenue so, notwithstanding promises to do so, I don't hold out any hope that any government of any political shade will abolish the tax when it is up and running. Nor do I believe that it will achieve any of its stated aims.

Just as many of the current generation do not appear ever to have heard or absorbed the story of the boy who cried wolf, they appear never to have heard or absorbed the old proverb "Never buy a pig in a poke".

We'll never rear them.

"Libertarian" and "Advocate of Carbon tax" is an oxymoron.

These people aren't libertarians.

No true libertarian would support this concept. The legal principle of remediating harm requires a direct link to the harm, not to the economic circumstances of either party. Income redistribution via an extra tax has nothing whatever to do with the principle of being civilly liable for acts which damage others, and it is a travesty of both the law and economics to pretend otherwise.

It doesn't even pass the fairness test, as in practice some rich people will not pay the tax and some poor people who are not experiencing any damage will get extra money. It's just taxation churn (with losses along the way) to buy votes by nobbling energy producers. The economic impact is to increase energy prices with negative flow-on effects through the entire economy.

There is a reason why companies that breach pollution regulations are fined, not taxed. It is because it is usually impossible or at best impractical to quantify the harm and embed it in the taxation system. If an individual can prove harm has been done to them, they can sue for restitution and damages based on what they can prove, which is as it should be.

Oh, and a 'revenue neutral tax' is an oxymoron. A tax is a means of raising revenue from one source and spending it on something else - otherwise there is no point in having the tax.

Very sloppy thinking, and nothing to do with libertarianism whatsoever.

Mique is displaying his partisanship. Whereas the typical Australian Labor government can accurately be described as centre-left, the current Labor-Green cabal is quite a way to the left of that, led (not accurate terminology in this context) by the Fabian socialist Gillard.

It is a common tactic of the Australian Left, when things aren't to their liking (and at least Mique is rational on the carbon tax), to exculpate themselves by claiming that the opposition is just as bad, being "all just politicians".

The fact is that Tony Abbott PM will abolish the carbon tax, to the collective sigh of relief of at least 70% of the long-suffering populace who never wanted the bloody thing in the first place. As Jack Hughes above rightly said, we don't have to pander to the Greens, who by that stage will be irrelevant - a repentant Labor parliamentary rump will make sure of that.

From the introduction to this article, am I correct in thinking that global warming due to CO2 [to the extent it might be sufficient to argued in court] is now the official position of this blog?

Chris M:

"Mique is displaying his partisanship."

LOL. If only you knew, Chris. :-)

Your _opinion_ that Tony Abbott PM will abolish the carbon tax will become _fact_ when he actually does it, and that without equivocation. I'll believe it when I see it.

I agree with you about the Greens. Indeed they have always been irrelevant. They would never have voted against Labor on any substantive issue likely to bring a Lib/Nat coalition into power.

Any tax on "carbon" is plainly bonkers. Trying to rationalise it is a waste of pixels.

From the Ecclesiastical Uncle, an old retired bureaucrat in a field only remotely related to climate with minimal qualifications and only half a mind.

Oh for a career as a Commissioner for Inland Revenue specializing in the carbon tax!

Tim Worstall’s argument-- “So this is what we know about climate change. We know there will be some effect from emissions, and we also are uncertain about what that effect will be. The uncertainty itself means that we should do something”—is totally unpersuasive.

At time scales that are relevant, say, 50-100 years or so, we don’t even know whether the effects of greenhouse gases will be positive or negative, as indicated by the above figure. But even if the net effects were negative, it’s doesn’t follow, as Tim Worstall claims, that “uncertainty itself means that we should do something”. This assumes that there is no opportunity cost to pursuing uncertain eventualities. Perhaps my DNA is cut from a different template, but for myself, the less certain something is, the less I worry about it. It seems that Worstall’s response would be just the opposite.

The uncertainty argument also lacks a certain symmetry. One of the problems we may face in the future is a global cooling. Potentially a 1 degree cooling may be worse for humanity than a 1 degree warming (because it could reduce food production, and increase deaths from cold). But given that cooling, too, is an uncertain-but-negative outcome, why is Worstall willing to pay a premium for avoiding warming but not one for avoiding cooling? In fact, why shouldn’t one argue that the possibility of cooling and its potential negative effects itself justifies greenhouse gas emissions?

A carbon tax, moreover, would have a number of societal costs that have not been factored into the calculation of an optimum carbon tax. First, agricultural productivity would decline for a variety of reasons:

(a) CO2 is plant food, and reducing it would reduce food production.

(b) A carbon tax would increase the cost of fossil fuels, hence, the cost of fertilizers and pesticides. But today, over 50% of the world’s food production depends on fossil fuels (via the Haber Bosch process, and pesticides. [ See, The Contribution of Fossil Fuels to (a) Feeding Humanity and (b) Habitat Conservation?, at http://wattsupwiththat.com/2011/12/11/the-contribution-of-fossil-fuels-to-a-feeding-humanity-and-b-habitat-conservation/.

(c) In addition, trade in agriculture inputs and outputs, which is entirely dependent on fossil fuels for transportation, would be affected. Such trade is one of the factors for the reduction in hunger around the world.

Consequently, the cost of food would increase, effectively increasing both poverty and hunger. To compensate for the decline in productivity, more land would have to be cultivated. Not only would this, offset, at least in part, some of the greenhouse gas savings, it would lead to greater habitat loss and increased pressure on the rest of nature (i.e., biodiversity and ecosystems). Ironically, the possibility of ecosystem and biodiversity impacts is one of the major reasons cited for concerns about global warming.

Second, carbon taxes would lower energy use, adversely affecting economic growth, and reducing all its attendant benefits, e.g., greater expenditures on health, research and development, education, etc. See, Linking health, wealth, and well being with the use of energy at http://wattsupwiththat.com/2009/10/12/linking-health-wealth-and-well-being-with-the-use-of-energy/.

None of this is factored into the (optimum) carbon tax calculations.

Worstall also ignores the fact that studies by Nordhaus (and others) which are used to estimate a carbon tax systematically underestimate society’s future adaptive capacity and, therefore, overestimate damages from carbon dioxide (and the magnitude of a carbon tax.) See, e.g., Goklany, Indur (2009), Trapped Between the Falling Sky and the Rising Seas: The Imagined Terrors of the Impacts of Climate Change, at http://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID1696005_code246538.pdf?abstractid=1548711&mirid=1.

One thing he does get partly right is that in the UK, consumers are already paying the carbon tax. I say, partly, because, in fact, they are overpaying this tax. See, Surprise! Current Motor Fuel Taxes Exceed the Estimated Social Cost of Carbon (SCC) in Most Industrialized Countries, at http://www.masterresource.org/2012/05/us-gasoline-taxes-vs-epa-socially-cost-carbon/. The same is true for much of the rest of Europe.

MarkT - "There is no legitimate way to trace damage done to one person's property directly to some arbitrary carbon emission by another". This is not the case in Australia where we have a much better understanding of cause and effect.

No seriously

Nice try RKS but fail. This excellent piece by Andrew - made more excellent by his admission that he ran out of steam (for who can do justice to such things first time around) - takes me right back to Myles Allen's concerns about democracy. I wasn't able to devote much time to reading, let alone responding, to Allen. Here's my take now, from about 50,000 ft:

1. Allen is genuine about the threat to democracy, freedom and the rule of law coming out of wrong-headed climate policy so we should view him as a key ally and well as deriding his doublespeak on climategate and the hockey stick. Not easy to pull that one off but it's a positive.

2. Adler and Worstall follow Lawson, Tol and many others in saying that a flat carbon tax is much better than the ragbag of measures at the moment. Surely we can all agree on that? That also takes the wind out Allen and co if they are being phony. The GWPF was there first. Put that in your peace pipe and smoke it.

The practical questions are

1. whether the ragbag can ever be dismantled, given the vested interests involved

2. whether it's better to have a carbon tax or nothing if it is.

I prefer nothing, because of the lack of proof that increased temperature, taken as a global average, causes net harm. I accept CO2 has a warming effect but we know so little about how much over centuries and it's far too complex a system for us to have any confidence that a reduction X in emissions will have effect Y on global temperature to within an order of magnitude of Y - and as I've said already it's unclear at what point an increase would do harm. Rhoda's right that litigation after the event would be the only way to go. The search for cosmic justice always goes awry according to Thomas Sowell. That leaves out the divine element (as Sowell cheerfully admits) and that's the real problem with the whole caboodle. Here endeth the lesson :)

Bish - What is your source for the graph of projected economic impacts? What is the baseline temperature for the graph?

Thanks!

[Whoops! I'll add a link]

I accept CO2 has a warming effect .....

Jun 4, 2012 at 5:42 AM | Richard Drake>>>>>

You accept it - well I suppose it's nice to be informed enough to be so positive. I accepted it once but having looked at research and discussion into different causes I am sceptical about the hypothesis.

Andrew gave the the impression, through his introduction, that he was positive in his belief that CO2 caused [some] global warming [as you yourself said you did above], and seemed prepared to discuss the level of this effect.

I, and others, do NOT accept that CO2 is a climate driver worthy of discussion, and asked if that belief in the properties of CO2 as a cause of [global] warming is now blog policy.

A contributor here a short while ago said Andrew Montford had stated he would not be surprised if AGW were found to be a fact. I have never seen this supposed statement by Andrew though I did not see him refute the allegation [if he did and I failed to see it I apologize to him].

As with all blogs, I like to know it's general philosophy on the subjects discussed and only Andrew can provide that information.

Trying to influence behavior through tax is tried and true - you can reduce consumption of particular goods by taxing them punitively.

But it begs the question of whether government should be in the behaviour modification game at all. Especially where:

a) the behaviour to be modified is likely of minimal consequence in the case of any particular individual,

b) the suggested alteration is, even on a society wide scale, most unlikely to actually make a measurable difference to the "problem" being addressed,

c) tax is not frictionless - it costs money to collect and redistribute and, more importantly, it may very well encourage a regime of mal-investment by distorting energy price signals,

d) by taxing a particular sector of the economy you are actively discriminating in favour of other sectors with unknown and unforeseeable consequences.

Before embarking on Tim's carbon tax mystery tour we might want to become a little bit more certain as to the harm being prevented and the costs of said prevention. Chirping away about revenue neutrality is largely irrelevant where the carbon dioxide "not emitted" is likely irrelevant to world climate and likely to be emitted in China instead.

As it happens, one of our finest economists, Henry Ergas, has published an article which touches on a lot of tax theory in today's Australian. It is paywalled, but you can access it free by typing into Google "treasury's arguments against royalties seriously flawed" and clicking on the link attached to The Australian. This quote is particularly relevant:

"First, a few basics. Taxes cause people to change behaviour, giving rise to efficiency losses. The losses depend on the degree to which behaviour is altered relative to that which would otherwise prevail; they also depend on what happens in the economy as a whole when those behavioural changes occur.

The overall outcome is captured in a measure referred to as the "excess burden" of taxation. Essentially, it reflects the loss in national income when a tax is imposed: to say a tax has an average excess burden (AEB) of 20 per cent means that on average, each $1 transferred from taxpayers to the government makes taxpayers $1.20 worse off.

In other words, taxpayers forgo $1.20 of income for the government to pocket $1, so the 20c taxpayers lose, but the government does not receive, is the tax's excess burden. Our tax system's excess burden as a whole is usually taken to be 20 to 30 per cent."

As I stated in much less rigorous and lucid terms than Henry Ergas has (above), the notion of a 'revenue neutral' tax is nonsense. There ain't no such animal. Tax is a drag on economic activity, over and above transaction costs, and even the Australian Treasury acknowledges it.

Anyone who claims that a new tax is a good thing per se is lying. A new tax is always a tradeoff between economic efficiency and a desired social outcome. And it is always a gamble, because whereas the economic efficiency is pretty reliable, the desired social outcome ranges from odds-on to 100-1 against. Trouble is, the people placing the bets are doing it with our money, so not even the usual constraints that apply on the racetrack are there to check their sprees.

CO2 clearly has some warming effect, but it is far from clear that this warming will be catastrophic. Indeed climate sensitivity appears to be low when measured. By accepting a carbon tax at any level, are we not accepting warming probably will be catastrophic?

It seems to me that these article are just a buttering up of the great unwashed to accept yet another unnecessary tax

CO2 clearly has some warming effect......

Jun 4, 2012 at 7:22 AM | mangochutney>>>>>>

The frequent use of this vague term, one suspects often for 'politically correct' reasons, is just as dangerous as leaving the stable door just a LITTLE bit open.

"In a marriage you have to do what it takes to get along - even if this means sometimes humouring people.

A nation does not have to work like that - why should we humour the greenies?"

In case you haven't noticed, a nation does work like that. The greenies have constructed vast nonsenses of subsidies and fines across the economy. They've already bought the worst and most expensive foot bath on our behalf. The "it isn't happening" line has lost the political battle.

We are in the mitigation of the effects of greenery phase.....

"Nothing should be 'done' until the 'problem' is identified."

The problem has been identified. It is the effect of the identified problem which is uncertain.

"The legal principle of remediating harm requires a direct link to the harm, not to the economic circumstances of either party. Income redistribution via an extra tax has nothing whatever to do with the principle of being civilly liable for acts which damage others, and it is a travesty of both the law and economics to pretend otherwise."

Compensation for harm isn't the point of the tax. Which is, to incorporate into market prices the decision about whether to cause harm or not.

And recall your Coase. Yes, sometimes direct compensation and negotiation does indeed work. But at other times it does not because transaction costs. Therefore centralised mechanisms must be used.

"At time scales that are relevant, say, 50-100 years or so, we don’t even know whether the effects of greenhouse gases will be positive or negative, as indicated by the above figure. But even if the net effects were negative, it’s doesn’t follow, as Tim Worstall claims, that “uncertainty itself means that we should do something”. This assumes that there is no opportunity cost to pursuing uncertain eventualities. Perhaps my DNA is cut from a different template, but for myself, the less certain something is, the less I worry about it. It seems that Worstall’s response would be just the opposite."

We're talking about two diferent kinds of uncertainty here. Uncertainty over whether anything is happening does indeed reduce the need to do something. Uncertainty over the effects of something which is happening increases the willingness to insure.

"One thing he does get partly right is that in the UK, consumers are already paying the carbon tax. I say, partly, because, in fact, they are overpaying this tax."

Of course I'm correct here. I was the first person to point this out for the UK. Some years ago, on both the ASI site and in a column for The Times. The correct Stern carbon tax on a litre of petrol is 11 or 12 pence. The fuel duty escalator has added 25 pence at least since Ken Clarke brought it in to "meet our

Rio committments".

"For all his excellent ideas, their basis lies in accepting not only the IPCC prognostications but a worldview dictated by the precautionary principle."

No. The precaturionary principle would say that as we are uncertain about the effects of emissions thus we must make no emissions until we are certain.

That is not my position at all.

"The trick with any tax-based solution is where to set the tax so that it impacts behavior. Otherwise it is yet another execrable circle-jerk"

No, a carbon tax is a Pigou Tax. It is *not* set at the level which will produce a certain or desired change in behaviour (that is much more a feature of something like cap and trade).

Rather, it is set at the level of whatever damage is done by the activity. If the damage done is $80 per tonne then that's where the tax is set. Thus, when people make a decision about whether to do something or not, the damage that will be done is incorporated into those market prices which influence their decision.

At which point, people will only do those things where the benefit they receive from having done so exceeds the damages they do to the future through that action. Things that produce less utility than the damage don't get done: things which do do.

Thus we maximise human utility over time.....which is the end aim of this whole economic management game after all.

The other is by Tim Worstall, here at the Telegraph blog:

So this is what we know about climate change. We know there will be some effect from emissions, and we also are uncertain about what that effect will be. The uncertainty itself means that we should do something. But what?

I've already explained this here. Don't listen to the ignorant hippies to our Left, or to those shouting that there's nothing to it from the Right. The answer is, quite simply, a revenue-neutral carbon tax.>>>>

Another non-science expert who knows all about the effects of CO2 [so HE says] but for some reason doesn't quite know how to quantify it.

Even if it has no effect, we'd better do something about it 'just in case' - forever the chant of the snake oil salesman.

Of course I'll listen to all he says like some trusting child at his feet.

And yes, I'm from the UK and I'm sick and tired of being ripped off by these 'city' types making a fortune out of the global warming scam.

The trouble is we already have a tax on climate although it is disguised under all different headings. Look at the money spent on the misleading research into global warming its in the billions. We already pay it.

You have to be prepared, if you accept this form of argument, to accept the same argument on a number of other issues. Its only going to work if you can show that doing this is going to result in a consistent and cost effective set of actions.

For instance, the same argument applies to particulate emissions. The same form of argument applies to the release of some chemical compounds (gender benders). The same form of argument comes up with the proposal to mass dose the over 50 male population with statins.

The logical problem is that the insurer lobby here has picked one relatively small or maybe non-existent risk, and has demanded that an totally uneconomic price be paid to insure against it by taking measures that are not proven to have any effect, thereby forgoing the chance of taking other measures against other and similar scenarios which may have real risks and costs.

It is rather like insisting that I take out huge amounts of insurance against having an accident while doing DIY, so using up the funds I could use to insure me against the much more likely and catastrophic cycle accident.

Yes, you will say, but the chances of an accident from DIY are much greater and the consequences worse? Really? Show me. This is where we came in, the demand was to insure against CO2 emissions producing catastrophic warming precisely because we did not know whether they will or not.

There is no substitute for finding out the real links and real probabilities before moving to expensive action. These arguments which try to get to action before doing so are simply expressions of an emotional liking for the actions in question. They have nothing to do with a rational approach to the alleged problem.

And yes, I'm from the UK and I'm sick and tired of being ripped off by these 'city' types making a fortune out of the global warming scam.

This interests. What on earth makes you think that I've got anything at all to do with the City?

This interests. What on earth makes you think that I've got anything at all to do with the City?

Jun 4, 2012 at 9:03 AM | Tim Worstall>>>>

Splitting hairs.

Your an economist [a fellow of the Adam Smith Institute I believe], and you've currently got a book about climate change to sell.

As economists advise both the City and Government [got to make a living somehow], and you've a clear vested interest in talking up the climate change issue, I don't think you're entirely neutral in the climate change arena.

Anyway, trying to tax something 'just in case' sounds pretty iffy to the suckers who'll end up paying it. Especially when an economist starts talking all 'sciency' and quotes from the IPCC of all places as an excuse for it.

http://www.bbc.co.uk/news/uk-england-suffolk-17159037

Question whats the point of taxing Carbon in the UK USA and the EU

if they dont have Carbon Tax in India and China etc

Carbon Tax dont matter how its distributed, it all goes on monolithic public spending and then inevitably on interest payments

No wonder according to Martin Durkin the UK is in 4 trillion pounds worth of debt

But can Climate Change cause 4 Trillion pounds worth of damage

I doubt it

But inept Goverment bent on reckless public spending and unfair taxation has

"Your an economist"

No, I'm not.

"and you've currently got a book about climate change to sell."

As does our host here. From the same publisher in fact. In the same series of books even. We might even note that one of the triggers for our host's book was in fact something I had written on these intertubes. Oh, and my book came out two years ago. So adding a link to it on a piece which covers the same ground isn't quite aggressive marketing.

"As economists advise both the City and Government"

Not me, innocent of that.

"you've a clear vested interest in talking up the climate change issue"

Difficult to see. I make some of my living by wholesaling (ie, the physical movement of, not playing with indices) one of the rare earth metals. This is used in one form of fuel cells, yes. So I suppose you could tenuously claim that more greenery, more fuel cells, more scandium sold, Timmy gets rich. But it is very much something of a stretch. The other half of my income comes from freelance journalism. No obvious link with talking up climate change there.

"Anyway, trying to tax something 'just in case' sounds pretty iffy to the suckers who'll end up paying it."

And you have missed a major point I'm making. We are all already paying these taxes. Just not in hte right places to have the desired effect. If they're going to take the money anyway wouldn't it actually be sensible to make sure they did something at the same time?