Bishop Hill

Bishop Hill Carbon debrief has its pants down

Jan 18, 2016

Jan 18, 2016  Greens

Greens  With the Port Talbot steelworks layoffs in the news, I was interested to see this tweet from Carbon Brief's Simon Evans this morning.

With the Port Talbot steelworks layoffs in the news, I was interested to see this tweet from Carbon Brief's Simon Evans this morning.

Reminder | Factcheck: The #steel crisis and UK electricity prices | @DrSimEvans https://t.co/vz4PP2ce3I pic.twitter.com/QrHcC7DXWW

— Carbon Brief (@CarbonBrief) January 18, 2016

The linked article, which seeks to divert blame away from energy costs, has this rather remarkable claim:

The share of electricity in steel production costs is around 6%, according to one estimate for blast-furnace steel production, used at most major steelworks. The Committee on Climate Change (CCC) says energy makes up 5.2% of costs for “basic metals”, which includes steel.

Now having worked in manufacturing industry in the dim and distant past I have a bit of feel for costs, and so the figure of 6% immediate jumped out at me as being very low. A moment's further thought brought to mind a geography lesson at about age 10, when we learned that steel was made from coke and iron ore rather than electricity.

Yet the whole of the Carbon Brief article discusses electricity costs alone.

This page has a representative set of cost figures for a steel mill, suggesting that coal (from which plants like Port Talbot manufacture coke on site) is as much as 25% of total costs. It also confirms electricity costs as 6% of the total.

I think it's fair to say that the Carbon Debrief has been caught with its pants down.

Being an inquisitive kind of chap, I asked Simon Evans to explain. His reply was as follows:

@aDissentient @CarbonBrief @LeoHickman as you can see, EII/EEF contributed to the article, & they didn't raise an issue with the analysis.

— Simon Evans (@DrSimEvans) January 18, 2016

Right. I'll drop a line to Richard Warren, the EEF source, to see if he wants to comment.

Bishop Hill

Bishop Hill

Simon Evans adds this:

@aDissentient @CarbonBrief @LeoHickman this is why we looked at electricity prices & the steel crisis: pic.twitter.com/xWnQ5kWJyz

— Simon Evans (@DrSimEvans) January 18, 2016 Bishop Hill

Bishop Hill

Ah! But I see from this that the statement about electricity prices was made in relation to closure/mothballing of three plate mills. Would electricity costs be more germane here?

Reader Comments (55)

Pants down, or pants on fire?

The only electricity intensive steel process is arc remelting of scrap in secondary and special steelmaking.

The rest of the processes are powered by coke and gas.

(Ex steelmaker)

Artsgraduates !

I visited the massive steelworks once and understood that 20% of its output was from scrap. This would presumably be the primary use of electricity, though the works itself seen at night is a huge user of electricity in any case. They are in the process of installing a generator in any case. I stand to be corrected, but that was my understanding.

There's also no accounting for energy prices on top of all the other bills including employees.

I have no problem with high energy, low value products leaving our shores for cheaper places but then nobody should be shocked by it. If the country wants some home grown industries like this then it needs to pay for them directly rather than expect other businesses to prop them up. Ministers need to be honest that closures are the result of British/EU policies and not try to pretend the companies are entirely responsible.

Just wait for Rudd and Truss to start crowing about our reduced emissions, while failing to join the dots.

If only all Carbon Brief claims on energy consumption were as reliable as Volkswagen's.

India has a MInistry of Steel:

http://tinyurl.com/hqw2e3n

Tata Steel Europe

http://www.tatasteeleurope.com/en/about-us/operations

I remember having a school visit to Ravenscraig in about 1967. Quite an amazing place for country boys to visit. At that time the plant produced its own coke. I remember, somewhat vague memories, that there was a plant which recovered various things from the coking process as well as the coal gas produced. I have no memory of what they did with them though.

Primary steelmaking also uses scrap steel but 80% of Port Talbot's liquid steel is from ironmaking using coke, followed by LDAC basic steelmaking. You add the scrap at this point, using the heat from oxidation of the carbon to melt the scrap.

http://www.tatasteeleurope.com/file_source/StaticFiles/Business_Units/CSPUK/Tata-PT-Visitor-Leaflet%20Interactive.pdf

I am a bit confused. What does the word 'Factcheck' mean when used by people like Simon Evans and Leo Hickman?

https://en.wikipedia.org/wiki/Steel

This is a complex technology that doesn't lend itself to headlines. For example, waste gasses produced in the steel manufacturing process are being used to generate electricity.

http://www.clarke-energy.com/gas-type/steel-production-gas/

Steelmaking is a 2-part chemical reduction process, not electrical. Iron oxide is reduced to iron by oxidation of coal/coke Steel is made by the addition of carbon.

Yet the whole of the Carbon Brief article discusses electricity costs alone.

Well, yes the CB article is a rebuttal of the claim that 'Green' taxes and Climate Change levies on electricity are a main factor in the declline of the industry, so the percentage of leccy used in steel seems to me a completely germane number.

Regardless of the relative prices in different countries, however, there’s a major problem with the argument that expensive electricity is at the heart of the UK steel industry’s problems. This is that electricity makes up a tiny share of steel production costs.

Phil Clarke, are you saying that taxes on burning coal do not apply to coke making?

If so we've solved our energy problems at a stroke.

Just call all coal fired power stations "preliminary steel mills" and they are green tax free!

The UK's CO2 output is negligible for climate change purposes so that's OK.

It would be cheaper than gas.

It would keep the Chinese off our nukes.

And it would save the birds from the wind turbines.

Phil Clarke, you've hit this out of the park.

One US foundry melts scrap steel to produce 36 thousand tons per year. They use electric arc furnaces to melt the scrap that are like giant welders. The electric bill is around one million US$ per year.

Phil Clarke, are you saying that taxes on burning coal do not apply to coke making?

That is not what I wrote. Read the article.

Phil Clarke, if the Carbon Brief article was written 'as a rebuttal', it would seem fair to conclude it is another bit of failed propaganda by the Green Blob, trying to deny liability for yet more UK job losses.

The same amount of steel will be produced elsewhere in the world using cheaper labour and power, before being transported to Europe, all done without business wrecking Green Blob interference, and more hazardous emissions.. Yet another Green Blob Hat Trick of own goals

Cedarhill

Yes, I checked to see if Port Talbot fell into the same bracket, but it doesn't.

O/T stuff removed.

The recently closed Teesside Works, the Scunthorpe Works and Port Talbot plant all use the Basic Oxygen Process which relies on iron from coke fired blast furnaces. The trigger for the closer of the Teesside works was the inability of the owners to pay for the coal needed for the coking plant. The last large scale Electric Arc plant in the UK was Thames Steel at Sheerness which closed in 2012.

This was in no small part due to the fact that Industrial electricity prices in the UK were almost double those in France, Germany, Spain and the USA. The Germans have been imposing rapidly rising prices on domestic users but their industrial prices are not subject to a levy to support renewables. Sheerness had been almost completely rebuilt since 2002 and was one of the most efficient and modern operations in Europe. Its now used to store cars imported by Volkswagen and Mercedes.

[BH adds: According to this Rotherham was an arc furnace.

In one sense Andrew and CarbonBrief are both right. BOF steel production is indeed highly energy intensive but not especially electricity intensive - and some of that electricity is typically generated on site using waste gases as fuel, reducing dependence on supplies via the grid. Electric arc is highly electro-intensive so its profitability is much more sensitive to the cost of electricity. Internationally uncompetitive electricity prices simply encourage investment in electro-intensive processes like electric arc to go elsewhere - they do nothing to reduce global emissions. EU BOF steelmakers tend to be more worried about the long term availability of carbon allowances than electricity prices, but even here marginal price disparity makes a difference. Other factors being equal, which plant would you close in a globally over-supplied market - one benefitting from competitive electricity, or one exposed to the highest industrial electricity price of any major economy?

Phil Clarke

"a rebuttal of the claim that 'Green' taxes and Climate Change levies on electricity are a main factor in the declline of the industry"

So what is Greenpeace's position on steel production, using all that coal? I get the impression that Greens will only be happy when industry is defunct, with perhaps just a small works for bicycles...

Jamesp

They'll advocate we make things from hemp.

So steelmakers in the European Union face falling prices and yet have to pay largely fixed high labour costs and increasing energy prices. As climate change policies tend to increase energy costs to what extent are they part of the problem?

For the integrated players like Redcar and Scunthorpe electricity costs are small but they do face costs on their carbon emissions via the European Union Emissions Trading System (EU ETS). Nevertheless, these costs have so far been very low as a result of the free allocation of emissions permits. The real problem of ‘carbon leakage’ for them is principally the blight of uncertainty about the future price of emissions permits in the 2020s and beyond, which does have a negative impact on new investment in Europe.

Climate change policies are not, of course, the main source of the problem the UK steel sector currently faces. Energy and labour costs are high before counting in any impact from climate change policies and UK firms, particularly those producing lower grade steels are struggling to compete a price level set by cheap Chinese exports. When operating margins are very low every additional percentage in cost does hurt. There are tipping points of bankruptcy and closure which are not easy to predict. However, uncertainty about future policy does act as blight. There is nervousness about committing major new investment to plants in Europe when the support that energy intensive sectors (like steel) will receive post-2020 is yet to be defined.

London School of Economics.

Some basic re iron and steel.

Iron ore FeO and carbon C is heated in a blast furnace and forms iron (Fe) and carbon oxide (COn).

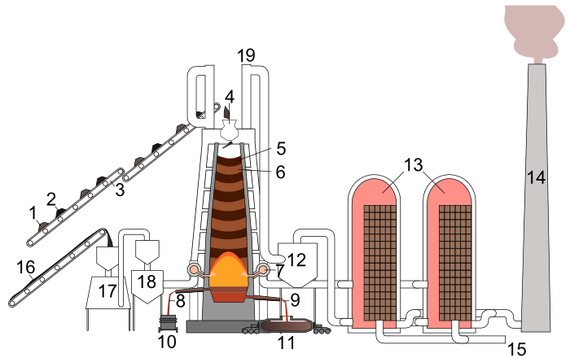

The picture from Port Talbot is such a blast furnace, The output, pig iron, is used as a raw materiel and requires further processing.

Molten iron, rich in carbon, is processed with oxygen to form steel, low in carbon. This procedure uses serious amounts of electric energy.

Its not the greens - they are the political vehicle, the scapegoat.

Its UK resident banks policy to absurd global overproduction.

It is a logical move.

jamesp and JamesG hemp bicycles? Surely bamboo for the frame, timber for the wheels and sprockets, and chains made out of the unchewable strandy string grown on the outside of celery. A useful purpose for celery may have been found at last.

Aha! Thanks Bengt

Rotherham was an electric arc furnace. The figures quoted by Carbon Brief were for a basic oxygen furnace. So electricity is the relevant figure.

Phil Clarke 1:30, do you really expect that London School of Economics article, and its author's affiliations, to be taken seriously?

Damage limitation pieces written by those who have helped cause the damage, are not unprecedented in failed Climate Science Economics, whether London Schooled or not.

Phil Clarke 1:30, do you really expect that London School of Economics article, and its author's affiliations, to be taken seriously?

In what respects is the article inaccurate or its conclusions unsupported?

Or are you just going to sling mud and hope some sticks? ;-)

How steel is made step by step

For plate mills see 'Hot Rolling'

DECC's electricity cost comparisons for intensive users a/o September 2015 (e.g. 79.2% above EU 15 median price) make for interesting reading, no wonder they have belatedly introduced some relief:

www.gov.uk/government/statistical-data-sets/international-industrial-energy-prices.

Phil Clarke, the article you refer to starts with a heading of "Structural Changes in the European Steel Sector". It then fails to mention EU legislation, and the disastrous CLIMATE CHANGE ACT. Then casually asserts that TATA Steel 'decided to mothball' UK plants. It does not mention Carbon Credit trading as being more profitable than making steel, and how the owners of TATA steel have been jolly nice to the UK Labour party, and they have been looked after as a result, with passports to more riches. The 'Hinduja passport scandal' is worth googling, I am sure Peter Mandelson and Keith Vaz would love to have their involvement given fresh publicity

After that brilliant example of not mentioning the Green elephant in the room, or its political keepers,, I lost interest. Is it worth reading on?

I wasn't seeking to throw mud, just facts and well established scandals.

Then casually asserts that TATA Steel 'decided to mothball' UK plants. It does not mention Carbon Credit trading as being more profitable than making steel, and how the owners of TATA steel have been jolly nice to the UK Labour party, and they have been looked after as a result, with passports to more riches. The 'Hinduja passport scandal' is worth googling,

Hmmmm.

In reports in December 2009 we said that Tata had used the carbon trading scheme to transfer steel production from Redcar to India, pocketing £1.2 billion in carbon credits at the cost of 1700 jobs. We accept this was wrong. Redcar was mothballed because a 10-year steel contract was not honoured and the credits could never have amounted to £1.2 billion.

Apology issued by the Telegraph after promulgating misinformation from Christopher Booker, this being his stock in trade. (Other Booker retractions/apologies are available).

I stopped reading after that re-heated zombie myth, was there anything factual? What have the Hindujas to do with Tata?

http://thinkprogress.org/climate/2010/07/06/206363/telegraph-christopher-booker-richard-north-retraction-apology-bogus-tata-pachauri-smear-ipcc

Energy costs TODAY will not be the only driver, the company will look at where they are going (i.e. up in the UK), and at unions threatening strike action over attempts to change their final salary pension schemes (http://www.bbc.co.uk/news/uk-england-33541704), the UK is f******d in more than one way when it comes to smokestack manufacturing.

Both Bishop's post and Carbon Brief are confused about this complex topic and need to start again.

.. about 25 years ago I did all my electrical engineering training at the steelplant in Scunny.

- I am in Singapore and Batam right now so don't have time to do a full dissection.

#A. Bishes clanger her is to try to illustrate an entire industry by just one part of the process ie the ore to iron stage.

(Blast-furnaces don't make steel , they make iron)without talking about the iron to steel stage or the rolling mills and the preproduction stages like cokemaking.

However he takes his lead from Carbonbrief

#B. The Carbon Brief article has a number of other mis-understandings and contradictions.

#1. That article comes up as having 7 comments yet, when you click you see now that comments are now switched off and all comments have been deleted

#2 Strawman #1 : "Yet some commentators have also pointed the finger at UK electricity prices."

The difference between a UK and Chinese steel plant is not just in the electric prices, but in all energy costs and laws like the Carbon floor price etc.

#3 Strawman #2 "plunging global steel prices" This focus is misleading as the steel industry doesn't just sell raw steel. Indeed one of the 3 plants talked about doesn't make steel. Caparo is a rolling mills operation it buys steels in and processes it and sells it on.

We used to compete on having better technology to produce better steel that China.

#4 \\For “extra large” industry, which probably includes the steel sector, the UK does have relatively high electricity costs, though not the highest in the EU.//

- Cyprus is the only higher one //guess how many steel mills they have ! (in the other chart it's Italy.

#5 However steelplants get some of their electricity from their own power stations.

#6 Germany VS UK comparison \\The data is somewhat at odds with the claim that UK costs are “twice” those in Germany //

The second chart shows UK electricity at twice the cost of UK's

I cannot answer what the energy cost for the steel industry is..it's complex.

Stocksbridge (Rotherham) is an example of high electricity use since it uses electric arc furnaces.

Tata might be reluctant to give facts due to it being the process of trying to sell off UK operations

..after making easy money in the years when it got generous carbon credits.

Tata Steel to Cut 1,050 U.K. Jobs as Steel Crisis Deepens

http://www.wsj.com/articles/tata-steel-to-cut-1-050-u-k-jobs-as-steel-crisis-deepens-1453118448?mod=pls_whats_news_us_business_f

Like most big important problems and industries, this one is complex and doesn't lend itself to headline solutions.

The Carbon Floor Price - note that GWPF already put out info re the UK Steel industry

#7 Germany VS UK comparison for ENERGY

- The situation is somewhat fluid. EU's approved of German steelmakers getting a energy subsidy by being forgiven some green taxes which has been happening for a long time.

- A similar policy in the UK has not been happening, but should kick in soon. Telegraph Dec 17 2015

"The state aid is expected to cover between 60pc and 70pc of the industry's green taxes, cutting the sector’s overall power bill by about £3.9m a month"

There was a warning in 2011

Lets roll with CB's figs even tho they could be massive underestimate

\\Can policy costs, making up maybe 1-2% of steel production costs, really be responsible for the current crisis in the industry?//

If customers don't buy your product cos it's 1-2% more than your competitors ... can that lead to you closing plant ?

Yep if your plant costs $millions to run per hour, you will close it.

Have plants closed ?

...yes they have.... 1-2% could have made all the difference.

Relevant quote from the middle of today's article in the Scunthorpe Evening Telegraph

David Cameron's family thru his father in-law does RECEIVE 1,000 pounds per day due to the wind turbines standing in front of Scunthorpe steelworks (Bagmoor)The BBC has 3 pages on today's story

- Tata Steel confirms 1,050 job cuts

- Live Coverage

- Background : Britain's steel industry: What's going wrong?."

oops #6 The CB second chart shows

Italy's electricity at twice the cost of Germany's

British energy trends third quarter 2015 vs third quarter 2014.

Supply and use of fuels.

Coke : -46 .3 %

Blast furnaces : -22.5 %

Coke use had already declined by 25% in 2014

Its a tiny component of total transformation

2014 total transformation (ttoe)

Electricity transformation : 39,492

Coke manufacture : 334

Blast furnace : 2,379

Its over.

Most folk would I suspect assume (wrongly) that the single market would go some way towards creating a level electricity market across the EU - I'm ignorant of the detail - but it seems not unreasonable to think that the carbon trading scam does follow an EU wide set of metrics which allows exploitation / gaming of the differences between states and it's clear that the bureaucrats in The Berlaymont supposedly charged with limiting absurd + damaging impacts where they can - either can't be arsed or are entirely happy to damage member states economies..... in cahoots with the Green Blob.

btw - Are we supposed to take Gadaffi - Grantham Institute seriously?

The economy is not a monster to be fed.

That is a Maoist pig Iron view of the economy

The UK via clever use of its resident banks has gamed the system to perfection.

The fact is the world is owned by the UK.

It has managed to entrap its jurisdictions in foreign currency loans.

They must devalue and export their physical wealth at ever increasing speeds.

Phil Clarke, have you checked your linked story for accidental/intentional inaccuracy?

This is what's supposed to happen, by design. The greens and their political supporters don't want there to be a steel industry in this country. China is about as close as they are comfortable with both a steel industry and their own hypocrisy, unless it also happens to be where they go on vacation. They also don't want a chemical industry either. There are other industries on the list.

This is not news. It is ingrained in British culture, Arts-education, and the BBC.

Isn't the price of CO2 offsets a greater problem than electricity?

On average making a metric ton of steel requires emitting 2 tons of CO2; most sources don't bother specifying but I assume this to be the actual CO2 emitted from burning gas, coal or whatever onsite, not from electricity generation (which in any case would have much smaller emissions).

Offsets go for 7€ or 5 pounds. So that's an additional 10 pounds per ton. And currently UK steel is going for about a 120 pounds per ton. Notice also that while this is the current offset price, for several years it was much higher.

https://www.quandl.com/collections/markets/industrial-metals

Of course this affects everybody in the EU and not just the UK.

tomo, the London School of Economics provided a credible education for GoDaffy's son. GoDaffy, his money, and his son have done wonders for the LSE's credibility on the world stage. The power of greed and money is a noted LSE subject of expertise.

Steel making in China results in the release of 2 to 3 times more CO2 than the same process carried out in Australia.

....and polypropylene, by the way, releases 18 times more CO2 in China based manufacturing.

Refs later... I'm on a boat. ..