Monday

May212012

by  Bishop Hill

Bishop Hill

Bishop Hill

Bishop Hill The world gas market

May 21, 2012

May 21, 2012  Energy: gas

Energy: gas In Ed Davey's interview on the Sunday Politics yesterday, UK Energy Secretary Ed Davey said that high energy prices in the UK were driven by world gas prices.

However, this is not actually true. As was pointed out to me some time ago, there is not actually a global market for natural gas, it being rather difficult to transport.

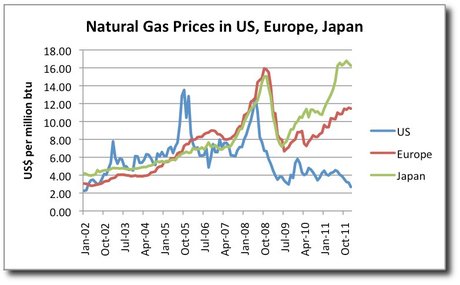

The following graph (source) demonstrates the point.

The difference between the low gas prices in the US and the higher prices in Europe seems to be due to the US having exploited its shale reserves while in Europe we haven't.

I think Mr Davey wants to keep it that way.

Reader Comments (26)

Coincidentally the LibDems produced a leaflet on my council ward saying how they had been active in reducing gas prices despite "rising world gas prices". I did email them to point out this was untrue but such trivialities as honersty clearly do not matter to them.

This is equivalent to a profoundly regressive tax rate. I can't believe leftists the world over aren't up in arms (metaphorically speaking) against it.

Hey, they have to protect their investments in Milford Haven haven't they.

Hundreds of millions spent on a new LPG terminal, not to mention the storage and transport infrastructure they built to add the gas to the national network.

I mean someones got to pay for this, and it just means that the poor tax payer , as usual will be shafted.

Construction of the £250m facility began in 2004, came onstream in 2009.

The shareholders in this project are 4Gas BV (20%) (Founder) and its customers BG Group (50%) and Petronas (30%). The gas exporting partners have 20-year arrangements governing the use of capacity rights, which allows each company to throughput 3bn cubic metres (106bn cubic feet) of gas a year, equivalent to around 2.2m tons of LNG per year.

"Shell proposes B.C. LNG project alongside Korean, Chinese, Japanese partners"

http://www.winnipegfreepress.com/business/shell-proposes-bc-lng-project-alongside-korean-chinese-japanese-partners-151560205.html

Does anyone expect a climate-change fighting British energy minister to tell the truth?

I watched Mr Davey also and I could tell he was lying because his lips where moving.

Also after on the south version they had a story about using poole harbour to create heat in what they were explaining works in the opposite way as your fridge, so far between the council and the Southampton Uni they have been looking into the fesability of this at a cost of 3/4 of a mill.

Ed Davey mouth being worked by DECC officials resulting in terminological inexactitude ? nah... couldn't be.

Yes I watched that arrogant, self-promoting, self-enriching, venal, mendacious, incompetent fool, yesterday on Sunday Politics. I do so admire thick politicians who think everyone is as stupid as they are, the lies (that's the polite version) just roll off the tongue so eloquently, do they not? They are truly TAPS, Thick As Pig S??t! AND we are supposed to look up to these individuals?

May 21, 2012 at 11:45 AM | Shevva

Shevva, Southampton has had a geothermal energy plant since 1986. If it was such a raving economic success they would be all over the south coast of England.

http://www.southampton.gov.uk/s-environment/energy/Geothermal/

It's at the back of the West Quay shopping mall. I bet most locals wouldn't even know of its existence despite walking past it every day.

Davey did look worried and quite shifty on the Sunday politics, with that frowny, knitted-eyebrows face so beloved of politicians.

Btw, Shell don't seem to be ideologically anti-frac - they have a large section on their website boasting about their 'hydraulic cracking' activities. Big companies, however, love government regulation, as it drives out their smaller, nimbler competitors who can't comply with hideously expensive bureaucratic red tape, the massive costs of which big companies then pass on to the public.

So was the purpose of the meeting with Davey et al to

a) play down the concept of shale with 'nothing to see, move along' comments about scarcity of UK shale resources and

b) load up health and safety regulations/CCS, thus driving out people like Cuadrilla, so that Shell, Schlumberger etc can hoover up the goodies later? This could then be spun as 'concern' (hence frowny face) for the planet, inhabitants and so on, reinforcing Davey's LibDem credentials at the same time.

More and more (and I wish it wouldn't) Mussolini's definition of fascism keeps coming to mind: 'Fascism - which should more properly be called corporatism - is when the government and the big corporations collude to defraud the public'.

Billy Liar @12:19 PM

I had seen this, knew what it was and wondered.... I am still wondering as the bureautwats pumping the PR bilge don't seem to like numbers.... at least the council don't seem overly keen to provide a link to the "open book accounting" apparently in place on this scheme - it should be prominent and it isn't and I think that's a mistake at best......

Cogen and GSHP seem like good partners - and I've seen several cogen sets at large hotels - who would not do it if it didn't pay.... and I don't mean subsidy either.

"not actually a global market for natural gas"

But it can be liquefied and transported by sea in converted oil tankers (LNG carriers). Since we import the stuff at Milford Haven, I assume we're already using it in power stations, so Mr Davey might like to consider how much cheaper power could be if we used our own gas.

Yep - mention shale gas to the DECC or relevant ministers seems to bring on an outbreak of 'La la la can't hear you la la la....'

You'd think they would be rejoicing at the UK's good fortune...

"not actually a global market for natural gas"

Maybe not fully Global, but truly international. If our continental cousins wish to pay Russia more for its supplies, then flow-rate & price to the UK's are affected.

Scroll down to the Map.

http://eng.gazpromquestions.ru/?id=6

http://www.gie.eu.com/index.php/maps-data/gle-transparency-template

Bish, I think your information on the transportability of gas is incomplete.

We have gas pipelines over 1,000 miles long in Australia, and export liquefied natural gas to China, which is, by European standards, a very long way away. And yet, our gas is much cheaper than yours.

You are right to say that your gas is expensive for reasons other than what the cost would be in a relatively unfettered market. Even if you bought it from the Continent, whether liquefied or by building a pipeline on the seabed, it ought to be much cheaper than it is.

I was itching to comment on the Ed Davey interview but others have already said it all. It was horrifying to think that our whole energy future depends upon the ignorance and lies of this moron. But I also think Andrew Neill let us all down by his compliant acceptance of what he knew was nonsense; he has become very BBC behaved on this Sunday show.

PS You don't ship LNG in converted crude carriers - these very specialised vessels are custom built.

David/jamesp

I'm sure the DECC would be rejoicing at Britain's good fortune — if they saw cheap energy as good fortune. But having bought big-time into the catastrophic climate change meme and, as we have seen from previous DECC releases, being in thrall to the eco-activists and their allies (I mean you have to at least grin at the irony of it before you start to weep) in the big energy companies — you know, the ones who are massively funding us "deniers" — the thought of cheap energy is an umitigated disaster.

It's not just the PM's dad-in-law that stands to lose mega-bucks if we start using shale gas to fuel traditional power stations. Every major electricity supplier in the UK is up to its neck in "renewables" because it is getting the chance to milk the customer for every penny it can get and with full governmental approval.

The very last thing those in power (political, environmental and electrical!) want is shale gas. Or thorium reactors that work. Or nuclear fusion should that prove to be possible. Think of the bankruptcies. Think of the embarrassment!!

PS As with the Beecroft report on red tape strangling business — the UK is in a class of its own when it comes to implementing EU rules and regulations and "setting an example". In mainland Europe the UK's attitude to the EU is seen as a joke. We whinge about it and at the same time go the extra mile or more to carry out its regulations even when these are discretionary. The number of times we shoot ourselves in the foot it's a miracle we can still crawl, let alone walk!

The reason the market is not global atm is that the USA still does not have the capacity to export LNG, it only has import facilities because it was a huge importer of LNG until shale. Those facilities are now being converted to export terminals but are not expected to be ready until 2015, at which point prices should start to average out (for LNG).

@ Vernon E

LNG vessels can be built to order and come in various designs, but there are companies who carry out oil tanker conversions to save time and money.

As the referenced article points out, US gas prices are driven by short term supply and demand considerations and a shortage of storage capacity. The international market in LNG is driven by long term contracts at predetermined prices which justify the significant investments needed to create and sustain the supply chain. An idea of investment involved can be gained from this BG Group video of the QCLNG project in Australia:

http://www.bg-group.com/MediaCentre/Pages/BG-Australia.aspx

Of course the area being drilled by Caudrilla is very close to existing gas pipelines - but that appears to make it all too easy for Mr Davey, despite his words about the need for energy security.

He is, it seems, another politician who studied PPE at Oxford, along with Cameron, Ed Miliband, Ed Balls, Yvette Cooper and, I believe, Mr Hunt. No doubt there are others. Their collective obsession with the CAGW hypothesis and the Big Lie that their legislation will control the climate is bringing both the University and that particular degree course into disrepute. This appears to be an extreme case of goupthink.

I think it would be very useful to see the UK price of gas on that there graph Bish. As it's my recollection that this diverges quite wildly at times from any of the price time series in your graph. I note that the BBC long ago stopped their price comparisons with continental countries.

The more cynically minded observers of UK gas prices comment regularly about how UK prices have a remarkable property of being just rising right to justify the next round of price hikes from manipulative retail distributors (Hello BG!!) who have already successfully resisted cheap gas from Norway and are as I understand it, fighting a link to the Nord Stream gas network.

The ransoming of water, gas , electricity and road fuel is accelerating and nobody out in politics or meejah land is calling it.... this really does not look healthy - at all.

The difference is one of economics. The capital costs of transporting are very high - whether for pipelines, LNG carriers or facilities for converting to LNG. However, huge disparities between regional prices are providing the incentives to invest. For instance there is a new generation of LNG carriers being developed, powered by the gas that would have previously been flamed off.

There is another reason why European prices are likely to fall. For strategic, as much as for economic reasons, Ukraine and Poland are developing their shale gas potential.

tomo wrote

quote The ransoming of water, gas , electricity and road fuel is accelerating and nobody out in politics or meejah land is calling it.... this really does not look healthy - at all.

unquote

But it is healthy if your metabolism cannot cope with an atmosphere containing more than 350 ppm CO2, and all these measures are designed with that in mind. Certain higher lifeforms become sluggish above that level, their finely-tuned brains slow down and they may fall victim to dim-witted huma... competitors. As can be seen from the behaviour of Mr Davey, this slowing is already causing cognitive disfunction.

I personally welcome the rule of our anthropophagous reptilian overlords.

JF

(No, I know what you're thinking, but follow the logic. Have _you_ ever seen Lord Mandleson blink? And can you think of any other reason that the bonanza of cheap energy is being resisted?)

The gas market is becoming global very rapidly. The pipeline network is growing fast and there is a huge expansion of LNG underway with Australia in the lead. As well as the US, Canada is building export facilities to replace the market it is losing in the US. Recently there have been huge gas finds in the eastern Med which will go to pipelines and in East Africa which will go LNG.

There is a key market dynamic in Europe which is changing. For ages gas prices have been linked to the price of oil, keeping our prices artificially high. That link seems to be breaking down so prices will change as contracts expire and a more open market develops.

If oil stays high, we may well see more Gas-to-Liquids projects and the like to realise the huge cost differential - in energy terms US gas is equivalent to oil at $10 - 15 per barrel.

I work in Alberta. I am tied into the gas market. I assure you that shale gas exploitation has NOT reduced gas prices, but oversupply has. Shale gas came on at exactly the same time as the economy tanked. Immediately gas was going into storage. But those with debts, staff and a need to maintain their fields have to sell it at whatever they can. Cash flow demands the gas get sold.

Shale gas is not, has never been, and cannot be cheaper to produce than conventional gas sources. See Arthur Berman re Chesapeake, Devon, shale gas economics. Shale gas is expensive. Right now prices are below shale gas costs.

This is a big, big issue: prices vs costs.

We in the industry are very aware of the problem as layoffs have happened big time, and programs are being shifted from 2012 into 2013 as we speak. The low prices kill shale gas and any drilling/completions that require big fracs and intrastructure.

I don't understand why this aspect is still misunderstood.

My understanding is that in the US, shale gas drilling is drying up but so much oil extraction is going on using fracking techniques that it's actually helping maintain the oversupply by bringing in associated gas as a side effect of the successful oil drilling.