Bishop Hill

Bishop Hill Gas prices are on the up

Dec 10, 2012

Dec 10, 2012  Energy: gas

Energy: gas The big six gas suppliers in the UK have all now raised their prices, with Eon the latest to break the bad news:

Four million households who get their gas or electricity from E.ON will face higher bills in the new year after the energy giant became the last of the big six to put its prices up.

The firm has announced it will put gas prices up by an average of 9.4% on 18 January, while electricity prices will rise by an average of 7.7%...

Chief executive, Tony Cocker, blamed the increase on rising wholesale energy and network costs, the cost of increasing the use of renewable energy, and the cost of implementing the government's social schemes which provide free or subsidised insulation.

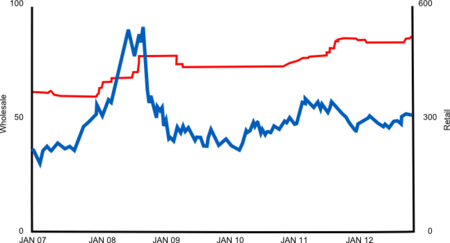

Here's a graph (source) of wholesale costs against retail costs (click for larger). Retail is in red, wholesale in blue.:

It is hard to avoid the fact that wholesale prices are well below their 2008 peak, while retail prices continue to rise. I don't think wholesale prices are the problem.

It is hard to avoid the fact that wholesale prices are well below their 2008 peak, while retail prices continue to rise. I don't think wholesale prices are the problem.

Reader Comments (40)

How long are we going to continue to put up with this?

What are the scales? 500 what as against 60 what?

As ever, the problem with graphs like this one is that you're not comparing like with like and this leaves plenty of wriggle room for the suppliers.

But we are starting to see a backlash from the suppliers who are increasingly prepared to include government charges in the figures they publish.

If I might (just for once) be permitted a reply to the troll —

I don't think that all the blame lies anywhere. What I think we would all like to see is an honest breakdown of the costs so that we all know whether the renewables portion is small or not and to what extent wholesale prices and company profits are being mis-represented (or not) in the information we are being given.

At present it's all "now you see it; now you don't" stuff which, rightly, makes us all suspicious.

Dung asks, "What are the scales? 500 what as against 60 what?"

Speed replies, "Follow the link provided above."

http://www.consumerfocus.org.uk/policy-research/energy/paying-for-energy/wholesale-retail-prices

Dung -

From here: Left-hand scale (wholesale) is the wholesale price of electricity, in £/MWh. Right-hand scale (retail) is "based on an average of UK prices for the 14 distribution regions, payment on receipt of bill and based on the current medium usage profile (16,500kWh per annum and 3,300kWh of electricity per annum)."

Edit: Speed proves he's worthy of the name ;)

"I don't think wholesale prices are the problem."

Of course they are. They're too low!

/sarc

Am I missing something here? It looks to me like wholesale prices have risen gradually and so have retail prices. But it also looks like us customers were shielded against that temporary spike in wholesale prices in 2008, I guess because of forward buying contracts etc...

Unfortunately we are just seeing in red the beginning of an anthropogenic renewables policy-forced retail price hockey stick, while the 'natural' variability just does what the market does.

From the graph, expanded and measured, retail has gone from 37 to 52 and wholesale from 383 to 526. That is nearly the same percentage rise. If you prefer ratios, 52:37 = 1.4 and 526:383 = 1.37

Another storm in a teacup from AM.

BitBucket, yes the ratios are the same, this means that the 'cut on top' of wholesale prices has also risen by the same ratio - why should the combination of govt tax and power company profit RISE by the same ratio as wholesale price? When everyone is being pushed, why should power companies and the government take an increasing margin on top of the actual cost for doing nothing new?

I have to agree with bitbucket (minus the snark). Using eyeball mk 1, it appears the slopes are similar.

I would rather have the tabular data to play with, but it looks like similar slopes, and the retail lags wholesale by a few months.

Traditionally, gas prices were set on *very long* term contracts and did not fluctuate. This allowed for capital investment in LNG infrastructure at export/import terminals. Big money involved so long term contracts mitigated risk. Lots of gas comes into UK from pipeline from Norway. Would be interesting to see the impact of new gas import pipelines on wholesale prices. I suspect little change, but don't have the figures to know.

> why should power companies ... take an increasing margin

If A rises by ratio R and B rises by ratio R then the ratio of A to B (margin) remains the same.

Power companies are not increasing the margin, it remains the same at around 10%.

Ofgem's analysis is here.

Energy prices don't NEED to be on percentage margins, they represent wholesale price + their fixed costs + profit, basically when the supply costs go up by x%, they are raising their profits by the same for no additional work on their part (their fixed costs remain largely unchanged).

The OFGEM link is telling... aha, just as I thought. Fixed costs pretty much the same. Margins GOING UP for no reason.

The headline is, "Gas prices are on the up" while the graph shown here is of electricity prices.

TheBigYinJames @ Dec 10, 2012 at 2:59 PM

"Margins GOING UP for no reason. "

Except that "Margins" were negative until 2009. They're energy/fuel supply companies, not Registered Charities.

The dual fuel table in the OFGEM figures:

Dec-2008 Customers bill = £1,215

Dec-2012 Customers bill = £1,390

The wholesale costs were in fact lower by £95 by Dec-2012. However, a significant rise is seen in the row "VAT and other costs" since VAT is about 5%, I wonder what the "other costs" actual means?

It would be much more useful if they tabulated separately the cost of renewables, social schemes (which are much higher due to imposed timescales) and network upgrade & changes to accommodate highly variable energy sources..

> Energy prices don't NEED to be on percentage margins.

Their risks increase (bad debtors), their borrowing increases (borrow more to buy wholesale) their insurance increases (value of stored assets) etc etc. At some point, when the margin, as a percentage, goes to low it would be more profitable to invest the money in a bank than to buy and sell gas.

Practically every company in the world works on a profit margin. It is one of the basic figures you look for when investing. A company that only makes a £1 for every £100 spent is a company that will not be able to maintain its infrastructure or to borrow for expansion (the margin needs to be above inflation at the very least). Its the margin over inflation that pays for these things.

Joe Public, if you look at the 'area under the graph' between the retail price and the total costs over time (rather than just the average rolling margin), you see they've more than made the money back during that slight dip back and more. Much more.

Don't be fooled by the 'negative margins until 2009' as if it had been that way a long time - that situation lasted far less time that the subsequent hike in margins has.

No they're not charities, but since they operate a cartel, it's supposed to be up to the regulator to make sure we get the best deal out of privatisation.

One of the other factors will be 'government obligations' as my supplier quaintly puts it. Curiously, he used to publish a pie chart showing this contribution (12%), but now combines it with taxes (19%). When I asked recently for separate figures, I received the following reply: "I am sorry to inform you that I am not able to provide you the information about green taxes".

I wonder why?

jamesp

Why not ask them?

Operating a cartel is illegal. The energy companies work independently in the same market.

Ofgem is obfuscating. The green policy charges are buried in VAT and other. This is deliberate, disgraceful and despicable.

TerryS, yeah right.

Centrica Residential (Business) energy supply Operating margins:

2011 6.4% (8.1%)

2010 8.9% (8.0%)

2009 7.6% (5.5%)

2008 4.9% (4.7%)

2007 8.8% (4.9%)

Apologies that this is definitely OT but for those of you who are not regular visitors to WUWT Willis Eschenbach has an interesting post here http://wattsupwiththat.com/2012/12/10/an-interim-look-at-intermediate-sensitivity/#more-75523

and now back to our scheduled programs

get fracking quick!

If the government can rush through legislation so that should Kate And Wills have a daughter so she then can become Queen.Then surely they can repeal or amend the most damaging aspects of the Climate Change act.

Wind Energy is Free, should be cheaper surely.At least deserves a Commons Debate.

TheBigYinJames - Dec 10, 2012 at 3:45 PM

Your "..yeah right.." (the unique double-positive = a negative) opinion suggesting the fuel/energy suppliers operating a cartel flies in the face of reality.

Of course, you do have proof (don't you) that there is a cartel operating? Have you presented Ofgem with your evidence?

Remember, now that the Gas Market is truly international, suppliers will ship/pipe to those countries willing to pay the highest prices.

there are cartels and cartels. There is an overt cartel in the diamond market. There are covert cartels in the oil industry - have you ever noticed how hard it is to find a petrol supplier massively out of line with the market? There is a covert cartel in mobile phones - prices per minute and per month are pretty similar on the whole. And there is clearly some kind of cartel in energy supply - ok let's call it non-destructive competition. Massive discounts are stricly time-limited or restricted in other ways. prices tend to average to the same over time, once special one-off, once-in-a lifetime deals are factored out. On the other hand, you kind of expect that. The infrastructure is the same, shared across the industry. It comes down to the price they buy supplies on the wholesale market and marginal differences in overheads in terms of billing and customer support and marketing (dreaming up new tariff plans), etc. Oh and of course the Green commitment.

I have a widget. It is something everyone needs and I have a near-monopoly. It makes me a load of money.

I've heard that someone has discovered a new widget that could end up forcing me to drop my prices. The alternative is for me to force up my prices for the time being, making me more money, and then buy into the new widget and pretend it costs as much as the widget I'm selling now. If it doesn't, I'll drop my prices a little bit and I'll look very saintly. Either way, I stand to make a shed-load of profit from it.

I've just been watching the BBC News Channel, and during the Business News section, at about 5.50, they covered the E-on price rise. They mentioned the reasons behind the hike in prices....well, they mentioned wholesale gas prices, costs of transport, and the cost of the government's social schemes. But the costs of renewable energy schemes somehow mysteriously slipped off the BBC's list.

Spooky, eh?

Does retail cost include taxes?

Retail cost I think includes VAT at 5% for domestic consumers standard rate for businesses.

There are three VAT rates- standard 20%, reduced 5% and zero rate 0%. There are big subsidies mandated for renewables, but charged to consumers. These are set to exponentially rise.

Environmental correspondents and their apologists regard the standard consumer 5% tax as a subsidy, and by logic therefore want consumers to pay full rate VAT at 20% on their energy bills.

The zero exempt zero rate tax applies to a stange mixture of things. Here's some

Burial and cremation including at sea

Incontinence products

Research at a college

Sewerage- both domestic and industrial discharges

Approved alterations to a listed building or scheduled monument but not for some crazy reason restoration work which is full rated.

Betting and gaming - including pool betting and games of chance, bingo - including remote games played on the Internet, telephone, television or radio

Finally weve found a graph shaped like a hockey stick, the result of green rent seeking on heating costs.

Seen on WUWT thread about the Dec !st anti-frac protest outside parliament

UK Sceptic says: December 8, 2012 at 1:36 pm

I live a handful of miles from the Preece Hall rig on the Fylde coast. That’s the rig that is at the centre of the “oh noes, we’re all gonna die from man made earthquakes” controversy. Never felt a thing. And neither did any of the activists trying to get the place closed down.

Bruce Cobb says: December 8, 2012 at 1:37 pm

They seem to hate humanity, especially their fellow Brits. I guess they really do want people to go back to the Dark Ages energy-wise, with all the resulting real pollution, lowered living standards, and shorter lifespans, particularly for poor people. Hard to say why.

Jeff in Calgary says: December 8, 2012 at 1:42 pm

Without the new fuel supplies that hydraulic fracturing will bring to the UK, their economy will vaporize. These people have no idea what they are actualy asking for. Sounds like a scene from Atlas Shrugged.

http://wattsupwiththat.com/2012/12/08/in-the-uk-just-a-few-hundread-people-show-up-for-the-national-climate-march/#more-75463

@snotrocket....it seems you a lot of faith in OFGEM! lol

Messenger

I could ask, I suppose, but the first reply sounded rather final. Worth a try, though...