Wednesday

Aug212013

by  Josh

Josh

Josh

Josh A Fracking Time - Josh 235

Aug 21, 2013

Aug 21, 2013  Energy: fracking

Energy: fracking  Josh

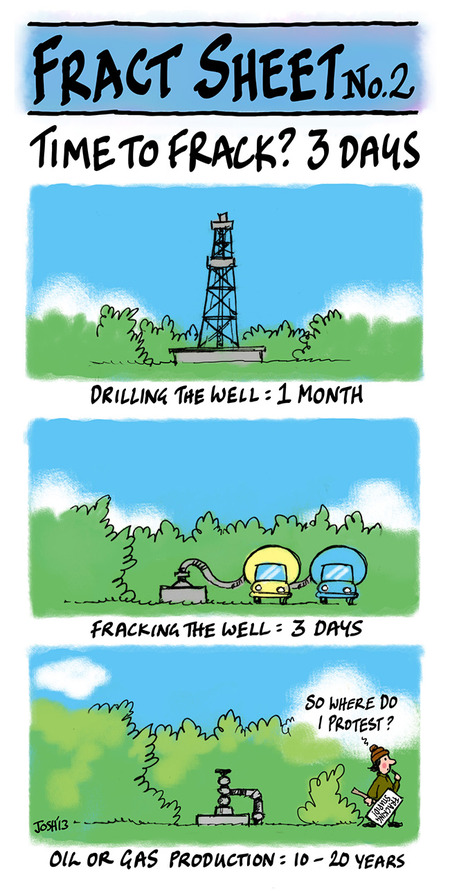

Josh There is so much to cartoon about Fracking at the moment that it is hard to keep up. I chose how long it takes to Frack a well, and I think water has to be next. And many thanks to James Verdon for all the information and checking. I am learning a lot!

Reader Comments (85)

EM

Sooner or later you are going to wake up to the idea that affordable, reliable energy is not a luxury but a necessity. Nobody has yet produced a shred of empirical evidence supporting the hypothesis that continuing to use hydrocarbons as the primary source for energy has or will, or even can, have the disastrous effect on the planet that the warmists and their choirboys in the eco-activist movement claim to be irrefutable truth.

Your link to New Scientist — oh, please: nothing new for decades and nothing scientific for at least as long — is ludicrous. The concept of a "carbon budget" is meaningless. It's smoke and mirrors; it's the pea under the thimble trick. Even if it had any meaning it's irrelevant. We are a carbon-based species on a carbon-based planet. Nothing we do can be done without carbon. You cannot allocate a certain level of carbon per individual or determine how much any individual uses or produces. There is no way of determining a carbon budget and if you could you would need to police every activity of every person on earth. It's a con trick on a par with the emperor's clothes.

And no, I don't deny "climate change". I deny that the current warming (now stalled if not actually stopped) is anything unusual in the history of earth, that the level of CO2 in the atmosphere is largely irrelevant and that the obsession with reducing it at any cost is going to impoverish this generation and those grandchildren that you are so concerned about. I don't know where you are living but I am concerned about the future of my grandchild and depriving her parents and her of the reliable affordable energy that they will need is not my idea of living anywhere but in La-La Land.

Entropic Man: Benefits: The price for natural gas has fallen by more than 50% in the US due to fracking. (http://www.eia.gov/dnav/ng/ng_pri_sum_dcu_nus_a.htm.) We were building huge facilities to import liquified natural gas from overseas; we are now planning or building facilities to export liquified natural gas. WIth new domestic natural gas and oil (both of which use fracking), the North America is talking about being energy independent in the near future. Domestic energy production means more domestic jobs and unemployment is negligible in many areas where fracking is being used. Cheaper domestic energy means our domestic industries are more competitive. Natural gas is replacing coal, which almost everyone thinks is good for the environment. (BEST's Muller thinks we should be helping the Chinese learn to frack so that they stop building so many coal plants.)

Costs: I've read a number of studies on possible environmental damage, but most lack proper before and after controls. I've read documents from the EPA's investigation of problems at drinking water wells near fracking sites and found little evidence supporting the idea that fracking caused contamination of nearby wells in the short period of time since fracking has been used. One site I read about most has very serious problems in an area that is highly dependent on groundwater (Pavilion, WY), but it also had numerous problems from earlier petroleum exploration and waste disposal when environmental regulations didn't exist. My guess is that legacy problems were responsible and I believe the EPA has quietly ended their highly-publicized investigation. Biological and fossil natural gas have always been present in some aquifers, but usually don't cause safety problems if properly handled. I haven't seen convincing evidence that fracking has significantly increased this problem, but it may have.

I did learn that fracking deep underground is unlikely to effect drinking water aquifers, but that the well casings of fracking wells passing through an aquifer could cause trouble if they leaked. Unfortunately, we haven't carefully protected aquifers from this problem in the past. And I wonder about safe decommissioning of wells. Experience shows that facilities with high decommissioning costs can be sold to shell companies with few assets once the profits slow. (The same is true for wind farms.)

Land owners, companies, their employees and local businesses all profit from fracking, but this doesn't include all of the residents and businesses in the rural areas that are being developed. They complain about the traffic, the loss of scenery, the damage heavy trucks causes to their roads, and the other problems with development. The Greens are trying to organize those who won't receive benefits (or will receive benefits indirectly) and they are succeeding in New York. Right now, Obama is visiting areas of New York were fracking is controversial and not yet permitted, but the Democratic governor is refusing to accompanying him.

My best guess is that fracking is a major net benefit. If alarmist fears about global warming do prove to be correct (I assume they have been over-estimated), we should NOT be focusing our attention on emissions from the Greens favorite targets like fracking and oil sands; our efforts should be applied across the board.

The steadfast death grip onto their ignorance is one of the more charming traits of the anti-fracking fanatics.

That fracking is a technology over 50 years old with a tremendous success rate? They ignore it.

That the natural gas and oil produced from the fracking process can improve lives locally and and in the world economy? They reject it.

That fracking does not use poisons or dangerous chemicals or leach them into drinking water? The facnatics ignore that and claim the opposite, sans evidence.

And that the anti-fracking fanatics depend on using climate fear to support their stance? The hunger of fanatics for doom and apocalypse stories is boundless. The success rate of doom/apocalypse promoters, as history points out, is 0.00%

Resources are not capital if you plan to leave them in the ground until the end of time. Their value is zero until you get them out of the ground and use them for something.

Iron + energy = steel ... which can be used to manufacture a wide range of goods.

Iron in the ground is useless. As is shale gas.

Correct. But if you spend more energy to produce shale gas than the content of that gas you have something that is worse than useless. Drilling equipment, gears, pumps, compressors, and the raw materials that were used to make them are not useless. When we employ them in an uneconomic activity we destroy that capital. And let us not confuse resources with reserves. If you hear companies talking about how they have plenty of reserves but they do not mention resources take your money and run the other way.

It may be necessary to leave most of the remaining fossil fuels in the ground, if the contribution of their use contribution to global warming is to be kept within bounds.

This is absolute nonsense. There is no warming that we need to worry about. We have not seen any statistically significant warming for nearly two decades and the supposed high levels have provided us with higher agricultural yields, higher biodiversity, and a higher standard of living. The leftist attack on society through the use of environmental false flags is no longer palatable to most voters.

Folks, Vangel is a bit of a troll. He shows up at the Carpe Diem blog every time Mark Perry posts anything related to oil/gas. Mark now uses the term "Saudi America" to reflect the changes of the past five years. Yet Vangel is convinced that fracking and horizontal drilling is all a ruse. Somehow he knows better than all the people risking their own money on new well exploration.

For five years I have asked Dr. Perry, an economist, to show that shale gas has been economic. He has never done so and has ignored all of the shale gas write-downs that have been reported. He used to hype up Aubrey McClendon and CHK as I used to point out that the hype was not backed up by real world results. Now that McClendon has lost his job and Chesapeake is selling off pieces of itself so that it can service its debts Dr. Perry no longer talks about shale gas any more even as the site rejects the posts that point this fact out. As for 'using their own' money you are very naive. The shale sector management groups no more use their own money than Pets.com or Grocer.com management used its money to fund their activities.

I work in North Dakota Bakken for an oil company. These are oil wells, not gas wells. Depletion is about 40% in 6 months. Note that this is not a problem as you get very high production at first, which pays off the well. Wells are typically paid for in less than a year. Then it is all gravy.

But that is the problem. Most IP figures for the Bakken are low and the production is not sufficient to pay the full cost of the wells. If you look at the accounting the typical depreciation cost is nowhere near where the production data suggests that it should be. And the 'cost' that companies talk about does not tend to include overhead, lease acquisition, or even the royalty payments. And the revenues are usually lower than the listed Henry Hub rates due to the transportation issues at the wellhead. Go look at any of the producers in the Bakken and take a look at their 10-K filings. Listen in on the conference calls and ask about the funding gaps. The Bakken is not a new play. We have already reached a level that is close to the peak and if you look at average well productivity you are looking at 130 bpd even though most of the wells are less than three years old. Sorry but the math does not work.

Whoa, Vangel! What a genius! Have you told the companies that? I’m sure that is something that never even occurred to them!

Seriously, though, this is what is known in the real world as “business”; companies have to take calculated risks to make money – if they are right, they make money; if they are wrong, they lose money. The only losers in the latter situation are those in the company; in the former, a surprising number of other people benefit, too – not least the consumer (i.e. you and I)!

So different from the “renewables” (oh, what a misnomer!); no losses can be made as all is underwritten by the tax-payer (i.e. you and I); in the unlikely event of any profits be made, then the only winners are the companies.

Not sure about you, but I know which I prefer.

Whoa, Vangel! What a genius! Have you told the companies that? I’m sure that is something that never even occurred to them!Seriously, though, this is what is known in the real world as “business”; companies have to take calculated risks to make money – if they are right, they make money; if they are wrong, they lose money. The only losers in the latter situation are those in the company; in the former, a surprising number of other people benefit, too – not least the consumer (i.e. you and I)!

No. What you have is a tried and true business model where insiders take a position and sell off shares to investors as they collect nice salaries for a few years. When that is no longer possible those insiders take their money and find another property or simply retire and live off their investment dividends. Do you really think that the management groups of space.com, pets.com, or grocer.com used their own money to set up their ventures?

So different from the “renewables” (oh, what a misnomer!); no losses can be made as all is underwritten by the tax-payer (i.e. you and I); in the unlikely event of any profits be made, then the only winners are the companies.

Not sure about you, but I know which I prefer.

Since I invest my own money for my account I will pass on both. But let me note that the management groups of alternative energy companies are not any different than the management groups of shale gas companies. Both know that they are working in a space where the economics are terrible. Both use other people's money. Both get nice salaries and will make money from their stock options until the game is over. In both cases the investors get screwed.

"Sooner or later you are going to wake up to the idea that affordable, reliable energy is not a luxury but a necessity."

So what do you do when it is no longer possible to provide it? There is no natural right to "affordable, reliable energy". It is only possible when cheap sources are available, or governments are willing to provide subsidies.

That will not last much longer. The era of cheap energy is fading fast.

EM:

You don't know the future, including the future of technology. How well would you have done with the predictions in 1913? This is why people here take such prophecies with a pinch of salt. We don't know either but the history or technology and innovation makes us dial down the gloom.

As for what human beings are capable of, in their search for power, that's not so glorious. Again, think 1913. Safer to avoid the centralisation of power and the ideologies that tend in that direction. A more rational use of the precautionary principle.

Vangel

Next time you try to divert a thread onto discussion onto your theories about shale gas economics I will block you. This has been done to death and my patience is at an end. You are welcome to start a thread on the discussion forum.

Re: Vangel

> The Bakken is not a new play. We have already reached a level that is close to the peak and if you look at average well productivity you are looking at 130 bpd even though most of the wells are less than three years old.

I'm always curious when somebody quotes a figure but doesn't give a comparison so I've had a look at the Bakken data.

It goes back to December 1953 when there was a single well. Here are are the average bpd per well

Jan 1954 - Dec 1963 85 bpd

Jan 1964 - Dec 1973 47 bpd

Jan 1974 - Dec 1983 28 bpd

Jan 1984 - Dec 1993 42 bpd

Jan 1994 - Dec 2003 12 bpd

Annual averages since 2003

2004 8 bpd

2005 14 bpd

2006 25 bpd

2007 54 bpd

2008 110 bpd

2009 122 bpd

2010 138 bpd

2011 134 bpd

2012 142 bpd

Guess what year they started fracking? According to wiki it was in 2008 when they reached the 100 bpd average. Production per well has increased since then.

Which is the option available in the first scenario, but not in the second. Whether you like it or not, your money is being used to prop up already-rich people generating very expensive electricity. No independent company involved in this is going round the houses, aggressively extracting money from the poor with the intention of giving it to the rich; in fact, the companies want to provide the poor with inexpensive power, an idea that you do seem to be rather at odds with. I agree with Richard Drake, in that we have no way of predicting the future (look at the scientific and social changes from 1913 to 1943!), though you seem determined to do just that. I also have to agree with the Bishop, too; you have hoisted this thread off on a tangent just to vent your spleen.

Guess what year they started fracking? According to wiki it was in 2008 when they reached the 100 bpd average. Production per well has increased since then.

Let us look at the ND Bakken data a bit more closely to see what really bothers me. First, by looking at the Bakken data we get rid of the influence of many of the old vertical wells that are producing at stripper status. I will be referring to the data found at: https://www.dmr.nd.gov/oilgas/stats/historicalbakkenoilstats.pdf

In January 2008 there were only 470 wells in the Bakken and they were producing around 74 bpd. By January 2009 the number of wells increased to 891 and the high production rates from the new wells was able to increase the average production rate to 113 bpd. By January 2010 the number of wells increased to 1362 and the average production rate increased to 122 bpd. The number of wells drilled in the next 12 months was larger so by January 2011 the number of wells increased to 2116 and the average production rate increased to 133 bpd. By January 2012 the number of wells increased to 3390 and the average production rate increased to 142 bpd. Over the next 18 months the well count exploded to 5887 but the average daily rate has gone down to 129 bpd.

See the problem? Shale wells decline rapidly and see most of their production take place in the first three years. Yet, despite the high IP rates and the high rates during the first year of production the addition of 74% to the well count was unable to prevent the average rate from going down by 9%. Even with $100 oil the shale producers are still unable to generate profit because the all-in costs are high, they get a discount at the wellhead, and are still looking at 20% plus royalty regimes that leave little behind in the way of profit if the proper depreciation rates are being used. This is why we are seeing the accounting games which show a well that has produced more than half the oil it will ever produce deprecated by less than a third. While these games can continue for a while the auditors will have to insist that some of the assets on the balance sheets are written off at some point in the next year or two. When that process begins the short sellers will get in the game and will drive the shares of most of the producers to zero. Of course, we could see a collapse of the USD and a huge increase in the price of oil that wipes away much of the debt used to drill these wells and save the producers. But that will present another problem; funding gaps that cannot be closed with cheap loans and no new loans to finance the drilling of new wells in numbers that can offset the decline due to depletion.

We cannot afford to act like simpletons when we examine this issue. If we do we are not very different than the fools who have been hyping up alternatives or have believed the narrative told by the alarmists. If we want to act rationally we have to look at the numbers and try to make sense out of them.

Which is the option available in the first scenario, but not in the second. Whether you like it or not, your money is being used to prop up already-rich people generating very expensive electricity.

Let me be very clear. As someone who supports free markets and oppose any intervention by governments, GSEs, or central banks I oppose subsidies and mandates that keep ineffective alternative energy companies afloat. My point here is that shale is not profitable outside of a few core areas where it makes sense. But given the proven reserves in those areas shale production will not make a dent in annual demand. That is it.

Now I could argue that the only reason why shale companies have been able to pull off the scam is due to the credit expansion activities of the central banks and changes in SEC rules about reserve recognition but this is probably not the place for such a debate. I am amazed that readers of this blog, who have been able to see through the faith based arguments made by the alarmists and who have taken a show-me approach in the climate debate, have made very similar errors as the alarmists did. They too have taken a faith based approach to the shale claims and have not bothered to take a few hours and look at the numbers themselves.

Have we got someone else paid to TROLL from the office of a company selling renewable scams ?

- don't let them lead you off the topic & down dark tunnels

So, let me get this straight, Vangel: these companies are extracting gas and selling it at a huge loss to the customers. The supply of this gas has been shown to be positive for several decades from any well, giving the customers the security of supply. These customers are then using this security of supply of an inexpensive energy in expanding their own businesses, and generating employment, income and wealth in their area.

I have to admit my stupidity, but cannot fathom exactly why you think this is a bad idea.

It costs about $10 million dollars to drill a well in the Bakken formation. At the current price of oil, ~$100 per barrel, the break even level is 100,000 barrels. A well in Bakken will produce this in the first couple of years and then continue producing oil for a decade or more. Ultimately, it will produce around 250,000 barrels. After about 10 years the rate will have slowed to around 400 barrels per month.

There are costs associated with running a well, but compared with the $10m for drilling the well, these are minor costs.

The price of oil might drop, in which case they will stop drilling, or it might go up, in which case its more profit. Since oil is a commodity that is supposed to be getting scarcer then I expect the price will rise.

All in all, a profitable business

So, let me get this straight, Vangel: these companies are extracting gas and selling it at a huge loss to the customers.

Yes. But note that while the debt explosion and negative cash flows are readily apparent the reported losses aren't. The accountants are quite able to use the SEC rules to depreciate their wells according to the ESTIMATED ultimate recovery figures given to them rather than rely on the ACTUAL recovery data from the production operations. This is exactly the same thing that semiconductor makers were doing when they depreciated $1 billion plants over ten years even though they were obsolete within two to three years. While the write-offs will have to be taken at some time in the future companies can ignore the problem until their production is no longer going up and some of the wells that are shown as having a positive value on balance sheets have to be written off entirely because they are no longer producing.

The supply of this gas has been shown to be positive for several decades from any well, giving the customers the security of supply.

Decades? That is not true. Most of the horizontal wells that have produced shale gas have been drilled in the past three years. Since they can produce tiny amounts of gas even five or six years out they will not be written off until long after most of the gas that they are going to produce has been extracted. But that can only happen if held for production backlogs still exist. Once the producers peak the auditors will insist that some of the assets are written off. (We have already seen at least $5 billion in write-offs over the past year or two. Expect a lot more in the future.)

These customers are then using this security of supply of an inexpensive energy in expanding their own businesses, and generating employment, income and wealth in their area.

A lot of companies claim that they will expand their businesses because of the cheap supply of gas. But I doubt that many of them can get long term deals that would give them access to below $5 gas long into the future.

I have to admit my stupidity, but cannot fathom exactly why you think this is a bad idea.

First, if a process is uneconomic it will not continue for very long. In five or six years the shale bubble will be in the rear view mirror and evident even to the most naive of us. But what happens when all that new demand increases price levels for companies that used low cost as the basis of their investment decisions? For non-core gas to be economic in most formations we are looking at $7.50 to $15 gas price. While that might stimulate a little more supply it will be a problem for investors in plant and equipment that were assuming $3.50 to $5.00 gas.

The bottom line is that there is no free lunch. To check what I am saying all you need to do is to look at the 10-K statements filed by primary producers in the shale sector. And please take a look at some of the serious analysis that uses real production data to see if the EURs make sense. Take a look at the write-offs by the integrated diversified players and try to figure out why the primary shale players are not doing the same thing.

It costs about $10 million dollars to drill a well in the Bakken formation. At the current price of oil, ~$100 per barrel, the break even level is 100,000 barrels. A well in Bakken will produce this in the first couple of years and then continue producing oil for a decade or more. Ultimately, it will produce around 250,000 barrels. After about 10 years the rate will have slowed to around 400 barrels per month.

Let us start with the cost. In many cases that does not include leasing costs, administrative overheads, and the cost of support infrastructure. Let us move on to the $100 price. While that may be the price quoted at the exchange it certainly is not the price at the wellhead. Those prices are significantly lower because the cost of collection, storage, and delivery have to be subtracted from the market price. And then we have the royalties rates of at least 15% and a 10% extraction tax and you are getting a great deal less of the revenue than you imagine. And I do not see much evidence that the EURs or 250K barrels are anywhere close to reality. The simple fact is that even though most horizontal wells in the Bakken are less than three years old the average production is only 130 bpd. Given the depletion rates being reported there is no way to make the math work once you add up all of the costs.

The price of oil might drop, in which case they will stop drilling, or it might go up, in which case its more profit. Since oil is a commodity that is supposed to be getting scarcer then I expect the price will rise.

The price changes over a period of a few years does not matter because shale wells produce more than half of their total production in the first two to three years. But suppose that you are correct and that the price does go up sharply. If shale formations were relatively uniform that would mean a lot of profit for the producers. But shale formations are not uniform and the data shows that the profit is only there for the taken in the core areas. New drilling will have to take place in the marginal parts of the formations because most of the core areas were drilled first when prices were much lower. The new wells will have lower IPs and will see a steeper decline rate as pressures drop faster. That means that you are drilling lower quality prospects and are likely looking at rising costs on the regulatory side. You would be better off looking at conventional plays or going to coal.

So, Vangel, what you are saying is that all these companies involved in gas and oil extraction from shale are (at no risk to themselves) leading all their investors into a massive loss-making enterprise that will only benefit the customers for a brief time before turning and biting back – hard! The result, according to you, will be customers paying far higher sums than at present, having been lulled into committing themselves to its use, a load of previously-rich investors having a shock at the revelation of their gullibility, and the few execs of the companies involved will be away, laughing themselves silly at our expense. Ho, ho, ho.

Hmmm. So what you are saying is that a large number of people are lying; even more people are too stupid to see through the lies, and only you actually know the truth. Ri-i-ight.

> In many cases that does not include leasing costs, administrative overheads, and the cost of support infrastructure.

It costs between $1,500 and $2,000 to lease 1 acre for drilling. This is ten time more than it used to cost. The $10m drilling cost is also an overestimate as costs have been decreasing recently and it now costs about $8.3m. This is the cost of drilling the well which includes getting the equipment there, installing it, drilling the hole and getting everything ready for production.

> Let us move on to the $100 price. While that may be the price quoted at the exchange it certainly is not the price at the wellhead.

The wellhead price is usually within 1-2% of the current barrel price. The ND Bakken crude is close to WTI (West Texas Intermediate) in quality which means it commands a higher price than heavy crude.

> And then we have the royalties rates of at least 15% and a 10% extraction tax and you are getting a great deal less of the revenue than you imagine.

There is royalties and tax to pay which will impact profit, but it will not wipe the profit out.

> and the data shows that the profit is only there for the taken in the core areas.

The 270,000 isn't the figure for the best producing areas or wells. It is the average. The best ones will produce 1,500,000 barrels over their lifetime and the worst will produce < 100,000. Overall, 90% of the wells will produce between 150,000 and 400,000 barrels.

Some further points.

Wells can be fracked multiple times to increase production.

The wells are expected to continue producing oil for 20-30 years.

Only 1-2% of the available oil in ND Bakken can currently be extracted so there is a large potential for better extraction techniques to improve productivity.

Stripper wells account for 18% of US oil production

Hmmm. So what you are saying is that a large number of people are lying; even more people are too stupid to see through the lies, and only you actually know the truth. Ri-i-ight.

They are not lying. Most of the companies have already admitted to losing money on shale and have made it clear that they need $7.50 gas to break even if you look at all of the costs. If you listen to conference calls you will hear CEOs tell listeners about the funding gaps and how they will need to borrow, sell more shares, or sell assets to keep their capital spending budgets intact. The 10-Ks show the negative cash flows and the explosion of debt on the balance sheets. Yes, the earnings do not show the extent of the losses but they are fully compliant with the FASB rules. Accountants are allowed to use the EURs as a basis for their depreciation cost because they expect those estimates to be true at some point. It is clear that SEC allows them to use the 6:1 BTU content equivalency ration when stating reserves even though the pice ratio is more than 20:1. And unlike the past companies in the shale space are now permitted to assume a certain amount of continuity about the formations and do not need all kinds of test wells when stating their reserves.

Note that Nortel did not lie either. It chose a perfectly acceptable depreciation schedule for many of its capital investments even though rational analysis should have told anyone that the depreciation should have been higher. I recall getting a value between $0.60 and $0.90 from the data reported in the annual reports when the price of the shares was $80 and rising. The people who misjudged the company were not stupid but they simply refused to look at all the data and all the footnotes that told the true story. When I look at Continental I see the same thing. Sorry but that is the way it is and in a year or two it will be clear if I am right or wrong.

It costs between $1,500 and $2,000 to lease 1 acre for drilling. This is ten time more than it used to cost. The $10m drilling cost is also an overestimate as costs have been decreasing recently and it now costs about $8.3m. This is the cost of drilling the well which includes getting the equipment there, installing it, drilling the hole and getting everything ready for production.

From what I can tell everything is in flux. It was not that long ago when CNOOC took a 50 percent interest in 850,000 acres in the Mississippi Lime formation. The price came out to around $2,500 an acre which was significantly lower than the $7,000 to $8,000 that Chesapeake valued the assets. As for the falling costs, a lot depends on the depth of targets and the length of the horizontal stages. What will determine the profit or loss of a well are the costs that go into it and the ultimate recovery rate. So far profits have been elusive for the industry.

The wellhead price is usually within 1-2% of the current barrel price. The ND Bakken crude is close to WTI (West Texas Intermediate) in quality which means it commands a higher price than heavy crude.

I think that you are missing something The quoted Bakken crude price is the price at Clearbrook, Minnesota. While that has been at a small premium to WTI it has mostly been lower but more importantly, it isn't the wellhead price for Bakken companies. To get the quoted Clearbrook price the companies have to get their oil to the terminal. This is why the rail companies have done as well as they have; they have cleaned up moving oil from the wells to the terminal and their revenues have come straight out of the pockets of the producers.

There is royalties and tax to pay which will impact profit, but it will not wipe the profit out.

That would depend on the ultimate recovery rates. The 'estimated' ultimate recovery rates work fine but the ACTUAL data does not support the estimated values.

The 270,000 isn't the figure for the best producing areas or wells. It is the average. The best ones will produce 1,500,000 barrels over their lifetime and the worst will produce < 100,000. Overall, 90% of the wells will produce between 150,000 and 400,000 barrels.

If that were the average there would be no need to keep borrowing and no negative cash flows after years of operation. I suggest that you check your numbers again because they are not supported by the SEC filings.

Wells can be fracked multiple times to increase production.

Yes but that costs a lot of money and you have a diminishing return problem.

The wells are expected to continue producing oil for 20-30 years.

Expected by whom? And why aren't those expectations supported by the production data? If you have a 70% increase in wells within 18 months and you still see a reduction in well productivity the math cannot support your claims. Most wells have their highest production rates early in the game. If they were really as great as you claim you would not have a 150 bpd average.

Only 1-2% of the available oil in ND Bakken can currently be extracted so there is a large potential for better extraction techniques to improve productivity.

That is the problem. You need a different technology to make shale work. That has been the story for decades and the promises have not yet been met.

Stripper wells account for 18% of US oil production

That is right. There are thousands of them all over the country. But they did not cost $10 million a pop to drill and have already paid for themselves many times over. On that front shale is a failure.

@Vangel 8/25 1:47am Most of the companies have already admitted to losing money on shale and have made it clear that they need $7.50 gas to break even if you look at all of the costs.

Prove it. Start by showing us links to two US companies' public statements in the past two years, that says they need, $7.50/mcf to break even in shale gas.

On the other hand, I have shown you the 10K's for Range Resources where they turned a small profit at $2.83/mcf in 2012. (Dillingpole on Shale, page 2, Aug 18, 2013 at 10:49 PM)

No doubt companies would LIKE $7.50/mcf.

There might be companies that will not play the game below $7.50/mcf.

No doubt there are companies that cannot turn a profit at $3.00/mcf.

But there is no doubt that some companies will turn a handsome profit at $6.00/mcf.

Which is proof enough that until demand for gas rises by shutting down coal plants, supply and profit will keep gas under $6.00/mcf for quite a while.

http://www.eia.gov/dnav/ng/ng_pri_fut_s1_a.htm (US EIA historical gas prices, spot and futures, Henry Hub, LA)

http://www.eia.gov/forecasts/archive/aeo11/source_natural_gas.cfm (US EIA price history and projections through 1990-2035)

You cannot have it both ways, Vangel. If the Gas decline curve is so severe that the majority of the reserves are produced in the first year, companies would not continue to drill for the stuff when it is selling for half their breakeven price. If no one could make money at $7.50/mcf, the price of gas wouldn't be below $5.00/mcf since 2009.

Put vangel + shale into Google and you get 3,860 results.

And the're not all here.

Is Putin paying for this effort?

ssat: The blog equivalent of Polonium-210?

Prove it. Start by showing us links to two US companies' public statements in the past two years , that says they need, $7.50/mcf to break even in shale gas.

"We are all losing our shirts today." Mr. Tillerson said in a talk before the Council on Foreign Relations in New York. "We're making no money. It's all in the red."

On Thursday, Shell indicated that the strategy faces challenges. Mr. Henry said the company took a pretax charge of about $3 billion—more than $2 billion after tax—on the $24 billion in North American shale assets it owns.

He added that finding shale oil has turned out to be more difficult than finding gas in shale formations. "There are sweet spots, but they are more difficult to find and develop," Mr. Henry said. Oil accounts for less than 20% of Shell's 300,000 barrels a day of North American shale production, he said.

Discounted cash flow models were developed for each of the shale gas plays in this study to determine the break-even gas price. The EUR/well in each shale play is the most important assumption determining the breakeven gas price. Exhibits 19 and 20 show the breakeven gas prices for the average EUR/well values discussed in previous sections of this report. Assuming fully burdened costs including land acquisition, the breakeven gas price ranges from $8.31/MMBtu in the Fayetteville Shale to $8.75/MMBtu in the Barnett. With point-forward costs, which include only well drilling and completion costs and variable operating costs, the breakeven gas price is lower, ranging from $5.06/MMBtu in the Fayetteville to $6.80/MMBtu in the Haynesville.

Now please show me which shale gas producers are self financing and do not rely on debt to finance their drilling activities. Where are the cash flows?

On the other hand, I have shown you the 10K's for Range Resources where they turned a small profit at $2.83/mcf in 2012. (Dillingpole on Shale, page 2, Aug 18, 2013 at 10:49 PM)

Nortel showed a profit too while it was losing money. The trouble was that it was not depreciating its investments as quickly as they were becoming obsolete. I have already pointed out that the deprecation costs for shale companies are based on the EURs, not the actual ultimate production of the wells. When you write off a quarter of the costs for a well that has given up half of its oil it is easy to report any income you want. But what you cannot do is hide the debt on the balance sheet or the negative cash flows that are causing the funding gaps. Mr. Joye, cited previously shows us the way. He uses Continental as his example but the logic is exactly the same. "Continental says their average Bakken well will yield 600,000 barrels of oil. Yet the US Geological Survey says lifetime production of a Bakken well is between 64,000 and 241,000 barrels. That’s the difference between a revolution and a scam."

No doubt companies would LIKE $7.50/mcf.

There might be companies that will not play the game below $7.50/mcf.

No doubt there are companies that cannot turn a profit at $3.00/mcf.

You can't make any money at $7.50/mcf because the core areas are nearly exhausted and the marginal areas will require a much higher price. Haven't you noticed the write-offs? And do you think that the process has ended? The bubble has yet to pop and by the time it does I expect Continental, Range, and the rest of the players to see their stocks take a similar path as that taken by Nortel, Lucent, and the other tech companies that played the same games.

But there is no doubt that some companies will turn a handsome profit at $6.00/mcf.

Which is proof enough that until demand for gas rises by shutting down coal plants, supply and profit will keep gas under $6.00/mcf for quite a while.

Actually, once gas goes to $5.50 the conversion to coal will begin again. Obama can't shut down all of the coal plants and there is no way that even those within his party will allow the EPA to do as much harm to the country as the EU countries did to themselves when they pursued the misguided path of green energy. Shale is not new. Fracking is not new. Horizontal wells are not new. What you see is created by an easy money policy, political opportunism, and rent seeking. But without real profits the whole shale bubble will implode in rapid fashion. Once we see rates go back up to more realistic levels the interest costs will make shale even more unprofitable. If rates fall because the economy implodes the collapse of demand will take prices even lower.

Sorry but there is no way to make the economics work with current technologies. I suggest that you actually start to look at the 10-Ks and try to understand the accounting a bit more. If you read carefully and look at all the footnotes you will discover what reality looks like.

http://www.eia.gov/dnav/ng/ng_pri_fut_s1_a.htm

First, Henry Hub prices are higher than the wellhead prices. Gas has to be moved to the distribution hub in Erath, Louisiana. That costs money. Second, the data shows losses in five of six years.

http://www.eia.gov/forecasts/archive/aeo11/source_natural_gas.cfm

This would predict that the current leases will have to be written off because there is no money to be made between today and 2035.

You cannot have it both ways, Vangel. If the Gas decline curve is so severe that the majority of the reserves are produced in the first year, companies would not continue to drill for the stuff when it is selling for half their break even price.

Of course they will continue to drill. The lease terms indicate that the companies have to keep drilling the properties or give the land back when the term ends. That would mean writing off the lease costs and immediate bankruptcy.

If no one could make money at $7.50/mcf, the price of gas wouldn't be below $5.00/mcf since 2009.

I think that you need to understand a few terms. A good place to start is by looking up The "held by production" provision enables energy companies to avoid renegotiating leases upon expiry of the initial term. This results in considerable savings to them, particularly in geographical areas that have become "hot" due to prolific output from oil and gas wells. With property prices in such areas generally on an upward trend, leaseholders would demand significantly higher prices to renegotiate leases.

Put vangel + shale into Google and you get 3,860 results.

And the're not all here.

Is Putin paying for this effort?

I do not deny that I have been a critic of the shale bubble. People like Mark Thorton, Joe Salerno, Marc Faber, Jim Rogers, and Peter Schiff were critics of the housing bubble before it began to pop in 2005. They didn't get paid to pan housing. They simply looked at the economic conditions and saw the bubble forming. In the end they were totally vindicated.

Never be afraid to stand by your principles and your analysis as long as the facts are on your side. If you can make 1000% by investing in gold or silver shares (or even coal) why would you bother with money losing shale companies priced for perfection?

Vangel:

Ref 1: "We are losing our shirts…" at $2/mmbtu = $2.06/mcf. Exxon.

Oh, big surprise. They need higher prices to make it work. That's why they want to build EXPORT LNG terminals.

But that is not all he said:

That said, the reasons for the price plunge are manifold. The first problem, obviously, is that there’s too much gas. This oversupply occurred, said Tillerson, “because the industry overshot when we had those $6, $7, $8, $9 prices, and we overdeveloped the supply.”

And drillers were able to overdevelop supplies because technology turned out to be better than expected: “We underestimated just how effective that technology was going to be, and we also underestimated how rapidly the deployment of that technology would occur — again, all in response to fairly high prices.”

What’s more, said Tillerson, “We grossly underestimated the capacity of both the rocks, the capacity of the technology to release the hydrocarbon, natural gas from the shale gas and now oil from tight oil rocks.” Forbes 7/3/2012 "Inside the Mind of Rex Tillerson"

It doesn't sound like Exxon is ready to fold to tent.

The industry underestimated how well the technology worked.

The industry underestimate how well the rocks would perform.

Exxon just wants prices to rise to the $5/mcf range ($6/mcf made them oveshoot the supply).

Vangel 10:24pm

You can't make any money at $7.50/mcf because the core areas are nearly exhausted and the marginal areas will require a much higher price.

Once again, assertion without support or reference.

Well, here is a reference from a skeptic. See Figure 10 of

http://www.theoildrum.com/node/8900

Gas Boom Goes Bust Jonathan Callahan Feb. 6, 2012

Which is a barchart of 30 shale plays and average price to achieve IRR = 12%. Most are in the $4.50-5.50/mcf range. None are as high as your repeated $7.50/mcf. It is a simplistic analysis, dated from 2011 (I think), without uncertainty ranges. Bars are of equal width belying the unequal potential of the plays. In reality, each play should have a price vs reserves curve. And it assumes costs are constant, which they are not -- they are dropping. (The article has some nice monthly price charts for natural gas spot and futures price trends. A good bookmark.)

Shale is not new. Fracking is not new. Horizontal wells are not new.

Multi-stage, high volume frack jobs, in long horizontal wells drilled in organic rich mature shale in 20 days --- THAT combination is very new and it working better than the industry expected. If you don't believe me, then believe Tillerson of Exxon (see 5:17am above).

I think that you need to understand a few terms. A good place to start is by looking up The "held by production"

(HBP… sigh!) As they say in the Real Estate biz, "Location, Location, Location." Yes, a major part of the current low price situation is that companies are drilling 1 location at $2/mcf to hold leases for a future 11 locations at a higher price. I suspect most royalty owners would rather have 1/6 of $4.50/mcf five years from now than $2.50/mcf today, too. Either way, it is part of the lease agreement and a key asset to be managed and financed responsibly.

What’s more, said Tillerson, “We grossly underestimated the capacity of both the rocks, the capacity of the technology to release the hydrocarbon, natural gas from the shale gas and now oil from tight oil rocks. ” Forbes 7/3/2012 "Inside the Mind of Rex Tillerson" (http://www.forbes.com/sites/christopherhelman/2012/07/03/exxons-tillerson-speaks-some-convenient-truths/)

Ahh, the good old days when Tillerson could pretend that shale gas was and could be profitable. Well, those days are over because there is no way to make money in the marginal areas of shale formations even at $7.50 gas. Someone somewhere will have to write off the acquisition costs and after the losses are taken there may be something left over for those that are good enough and careful enough to produce what is left. (Note that most of the gas from the prolific core areas is now gone. It was sold at a loss and cannot be sold for an economic profit again.)

And where exactly is the admission that drilling HAD to take place because of 'held by production' clauses in lease contracts? This is actually very important because it forced companies to drill at a loss rather than wait until better prices came along. If they did not continue drilling the primary producders would have to write off the value of their leases and show negative equity on the balance sheets.

It doesn't sound like Exxon is ready to fold to tent.

The industry underestimated how well the technology worked.

The industry underestimate how well the rocks would perform.

Exxon just wants prices to rise to the $5/mcf range ($6/mcf made them oveshoot the supply).

How naive can one be? The value of the purchase to Exxon was not the gas but the fact that a 6:1 boe conversion rate that could be used to hide a very obvious fact; Exxon has an oil reserve contraction problem. The company produces quite a bit of oil each year but it isn't buying or finding enough to replace that production amount. One cheap way to get around the problem is to acquire a shale gas company that has claimed massive reserves and to pretend that the operations could be economic once prices go up. The loss taken when producing this gas is not vey important in the scheme because the company, unlike the primary producers, has plenty of cash flow from operational activities to cover the funding gaps. This allows the overvalued shares to be used as paper when acquiring operators with conventional reserves. When the bubble pops Exxon can claim to be a victim but the huge price increase for its remaining reserves will more than make up for being fooled.

Once again, assertion without support or reference.

Well, here is a reference from a skeptic. See Figure 10 of

http://www.theoildrum.com/node/8900

Gas Boom Goes Bust Jonathan Callahan Feb. 6, 2012

Which is a barchart of 30 shale plays and average price to achieve IRR = 12%. Most are in the $4.50-5.50/mcf range. None are as high as your repeated $7.50/mcf. It is a simplistic analysis, dated from 2011 (I think), without uncertainty ranges. Bars are of equal width belying the unequal potential of the plays. In reality, each play should have a price vs reserves curve. And it assumes costs are constant, which they are not -- they are dropping. (The article has some nice monthly price charts for natural gas spot and futures price trends. A good bookmark.)

First of all, I did support my claims. I provided the analysis done by Arthur Berman, who got fired for saying that Chesapeake and other players could not make any money once the full costs were used. The CEO of Chesapeake called him a, ""a third-tier geologist who considers himself a reservoir engineer, that somehow [knows] more about the shale gas revolution in America than companies that have combined market caps of almost $2 trillion and have spent hundreds of billions of dollars to develop these new resources, I mean, it's ludicrous." Well, Berman proved to be correct and Aubrey McClendon was asked to step aside after Chesapeake had to sell off many of its best assets to pay off the interest on its debts.

Now let us go to your reference and see what was written. We read, "While I am often skeptical of corporate reports, this presentation answered a number of questions with detailed information and charts.) Slide 11 from this report contains information from the Goldman Sachs report on the NYMEX price required to produce a 12% Internal Rate of Return — the threshold for a project to receive financing. Transcribing the information from the Range Resource presentation and adding on $3/mmbtu and $4/mmbtu thresholds paints a rather ugly picture for the shale gas industry today as seen in figure 10)."

Got that? The chart comes from a GS analysis reported by Range. The problem is that GS is using the EURs as gospel without questioning the 'E', which stands for ESTIMATED. Berman makes no such errors. He actually uses the real production data and figures out the average UR that is suggested by the reported data. And note that Berman also says that you could make money at $5 if you do not use the 'full-cycle costs' but are only concerned about the 'point-forward costs'. Your table does not say which costs the analysis is based on and does not mention anything about the likelihood of the EURs being achieved in the real world.

For more on this you can take a look at: http://www.theoildrum.com/node/8212

And let me note that it is easy to prove me wrong. Show me any producers that have been able to generate positive cash flows from shale operations that have been able to close the funding gaps. Why is it that you see all of the primary producers who rely on shale gas and oil having to take on more debt even though many of them have been working in the shale space for nearly a decade? These are not conventional operations in which production is steady for decades and the cash flow comes is at a relatively constant rate for each well for years into the future. These are operations where most of the well revenues come during the first two to three years if not sooner. If there were real economic profits to be had the wells would begin to generate enough cash to fund the drilling of new wells and the need for new debt would go down, not up. And why would companies depreciate wells at a much slower than the production data would indicate was reasonable? Why would you have such a huge discrepancy between the reported earnings and the actual cash earnings?

http://www.afr.com/f/free/blogs/christopher_joye/the_real_oil_on_us_shale_may_be_w07tCAT80ChWN4RYUjcgpM

Multi-stage, high volume frack jobs, in long horizontal wells drilled in organic rich mature shale in 20 days --- THAT combination is very new and it working better than the industry expected. If you don't believe me, then believe Tillerson of Exxon (see 5:17am above).<?b>

I have been around long enough to pay more attention to actions than to words and to pay attention to what is really important. From what I see, Tillerson is writing down some of his shale acquisitions because they were unprofitable. That means that he overpaid. The accountants in the shale sector are showing a huge discrepancy between the reported earnings and actual cash earnings. That is the same thing that companies in the tech sector were doing in the late 1990s before they had to write off a huge portion of their balance sheets. And from what I see I don't care if the wells exceed expectations if they cannot generate economic profits. I am in this for the profits, not the stories. If I wanted to hear a good story I would go to a pub, not listen in on conference calls. Pubs are more fun and the people there tend to be a lot more aware and honest.

Yes, a major part of the current low price situation is that companies are drilling 1 location at $2/mcf to hold leases for a future 11 locations at a higher price. I suspect most royalty owners would rather have 1/6 of $4.50/mcf five years from now than $2.50/mcf today, too. Either way, it is part of the lease agreement and a key asset to be managed and financed responsibly.

Actually, once the production level falls off they have to drill again, and again, and again. Note that the core areas are drilled first, which means that the cheapest to produce gas is being sold at a loss with the expectation that the more expensive gas will generate enough profits to pay back all the debt, finance new drilling activity, and have something left over to pay a dividend some time in the future. I don't know about you but I am not that much into hoping and wishing.