Bishop Hill

Bishop Hill Men of no meaning

Dec 7, 2013

Dec 7, 2013  Climate: Sceptics

Climate: Sceptics  Greens

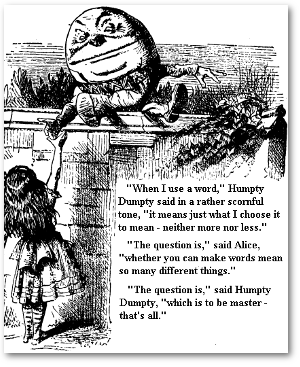

Greens  James Delingpole is on vigorous form, in a groove that this blog also treads from time to time, namely the misuse of the English language to score political points. His particular complaint is the "let's all pretend that fossil fuels are subsidised" meme that many of the more ludicrous members of the green fraternity find so attractive at the moment:

James Delingpole is on vigorous form, in a groove that this blog also treads from time to time, namely the misuse of the English language to score political points. His particular complaint is the "let's all pretend that fossil fuels are subsidised" meme that many of the more ludicrous members of the green fraternity find so attractive at the moment:

This fossil-fuels-more-subsidised-than-renewables meme has been spread, inter alia, by the Guardian's ludicrous Damian Carrington; by Labour MP Barry "Dork Brain" Gardiner (Vice President of the sinister GLOBE international); by green pressure groups; by the Overseas Development Institute; and by the IMF which, impressively, has put global energy subsidies at $1.9 trillion – the majority of these, apparently, for fossil fuels…

This is undoubtedly an abuse of the English language and one so egregrious that even the noble and learned Baroness Worthington has found herself unable to support it.

As I've said before, if you don't use words with their common meaning then nobody can trust a word you say. So when peers and MPs who make these claims about fossil fuel 'subsidies' tell you they have 'no conflicts of interest', that they only make 'honest expense claims' or that they 'didn't have sex with that woman', you should probably assume the worst.

Reader Comments (64)

I am not an ideological anti-taxation nut. I just wish governments would be more open and honest with the public about where they get their money from. Then let the public decide if it's really benefiting them or it would be better to do things differently.

Johanna, you are happy to "feed the troll" until you realize your arguments are a crock of sh*t. Then you hide behind DNFTT.

Kellydown, nationalization etc occur when countries realize that resource companies are exploiting them. That realization is now universal, but you can deny it. Add it to you list.

RR, the poverty of your outlook is typical of those on the extremes of politics. If you ever return to the real world and you might recognize that issues are never as black and white as you paint them.

"All tax is legalized theft" is just a slogan. Anyone giving it a few seconds' thought will recognize it as total bunkum.

Chandra, I'm beginning to wonder if you understood anything I was telling you.

Nationalisation ebbs and flows and these days is mostly favoured by populists and dictators. There is no one-way trend.

They nationalise on the back of the "exploitation" charges you have reiterated, then call the private companies in again when it all starts going to shit a few years later.

I've seen it happen several times in my 35 years in the drilling industry. The latest manifestation of your "realisation" is the pitiful sight of the Ecuadorian leader pleading with the Chinese to come and rescue the local oil industry after kicking out relatively responsible corporations like Chevron . Do you really think the Chinese state-owned companies will be better for Ecuador?

I'm no lover of big corporations but they have their place, they vary a lot and experience soon tells you which ones are better than others.

Your naiveté could be considered charming, Chandra, if it wasn’t so dire. I am not an “ideological anti-taxation nut”, I am just anti-taxation – everybody should be anti-taxation, including the government!

Take a look back through history: give the government £1, and they will want £2; give them £2, and they will spend £3. The basic principle is that we should all avoid paying tax as much as we legally can – we are more able to determine where our money should be spent, not the state, and, in doing so, will provide more gainful employment than the State ever can or ever will. What the State does manage to pry from our hands is then spent on the bare necessities of the country; for the State to feel beholden to so generously return some of our money, and expect us to be effusively grateful, does suggest that the State is taking rather too much of our money from us.

Oi, "ideological anti-taxation nut” was my phrase!

Didn't say there was anything wrong/i> with being one.

I have to wonder where the likes of Chandra (for he/she represents a common enough strand of opinion) derive the idea that nationalisation (note UK spell-check/dictionary, no US imperialism for us!) is now "universal" .

The biggest nationalisers in the world, Russia, China and India, have in recent years all opened up to non-state resources companies, because they want their expertise, efficiency and experience. It's pretty much the opposite of what Chandra claims to believe.

It is stretching the use of language beyond breaking point to insist that reducing someone's (or something's) taxes below what they could be is the same as subsidising them. It would all be notional anyway, since what they could be taxed is merely an invented figure.

A subsidy is necessarily a net positive flow from the provider of the subsidy to its receiver.

Even the Inland Revenue (or whatever it calls itself this year) never talks to taxpayers about how it subsidises them (via their tax allowance or by the fact that their tax rate is less than 98% or whatever).

Some words on the notion that tax is a form of theft: http://thebackbencher.co.uk/tax-is-thef/

Sorry, kellydown. I meant to credit the phrase to you, but it slipped my mind, and shall accept a slapped wrist. It was the American philosopher, Rothbard, who said that the state is an institution of theft writ large (thank you, Godfrey Bloom, MEP); the present incumbents of much of the western countries are testament to that idea, as our personal income is chipped slowly away – call it tax, call it levies – and, with it, many of our freedoms. Persons such as Chandra seem to be unable to see this, and are prepared to swallow every state lie, hook, line and sinker.

Of course, there is the possibility that Chandra is actually funded by the state lie…

Apology accepted but you drove me into a fit of italics.

I don't mind the state or municipalities taxing me for infrastructure but it impoverishes us all to trust them with more than that.

Ditto moi, dearie...

@Chandra

Obviously not. While plundering/taxing less money from someone (compared to someone else) is favouritism, it is clearly not the same thing as giving them money plundered from someone else. You are being deliberately deceptive.

5:03 PM Chandra

oh dear.... don't get out much - do you?

tax Definition from the net -

A fee charged ("levied") by a government on a product, income, or activity. If tax is levied directly on personal or corporate income, then it is a direct tax. If tax is levied on the price of a good or service, then it is called an indirect tax. The purpose of taxation is to finance government expenditure. One of the most important uses of taxes is to finance public goods and services, such as street lighting and street cleaning. Since public goods and services do not allow a non-payer to be excluded, or allow exclusion by a consumer, there cannot be a market in the good or service, and so they need to be provided by the government or a quasi-government agency, which tend to finance themselves largely through taxes.

Read more: http://www.investorwords.com/4879/tax.html#ixzz2mvQP6h2V

my parents/grandparents/me don't mind paying tax to support the basics for our society to thrive (but not anything wasteful)

get rid of the wasters/parasites who are draining the majority of tax payers money only to feather bed there agenda/lifestyle/retirement.

dougie, I have found myself on the same site (investorsnet) when looking things up. It is not too bad, but is certainly tinged with Keynesian (in the post-modern sense) economics. Street lighting and cleaning are all very well, but the vast majority of our taxes are spent on much more controversial, and more expensive, things.

It's a definition which ignores the elephant in the room.