Bishop Hill

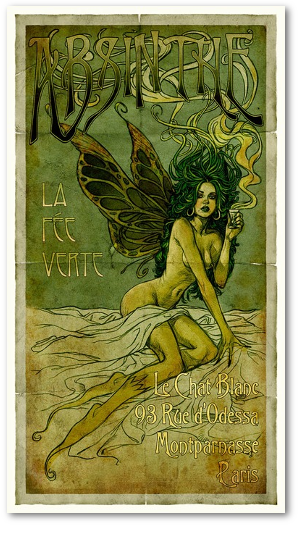

Bishop Hill Green fairies

Dec 2, 2013

Dec 2, 2013  Climate: Parliament

Climate: Parliament  One sometimes wonders if members of the House of Commons Environmental Audit Committee inhabit a sort of a green fairytale land. It seems as if no policy measure is ever too silly to find its way into their recommendations or an opinion too cockeyed for them to adopt.

One sometimes wonders if members of the House of Commons Environmental Audit Committee inhabit a sort of a green fairytale land. It seems as if no policy measure is ever too silly to find its way into their recommendations or an opinion too cockeyed for them to adopt.

As an example, take their report on energy subsidies, published today, which boldly declares that fossil fuels are subsidised by some £12bn per annum in the UK.

Globally, subsidies for fossil fuels exceed $500 billion a year. They are inconsistent with the global effort to tackle climate change, providing incentives for greater use of such fuels and disincentives for energy efficiency. Energy subsidies in the UK are running at about £12bn a year; much directed at fossil fuels. There is no single internationally agreed definition of what constitutes energy subsidy, which has provided a way for the Government to reject—erroneously, in our view—the proposition in some areas that it provides energy subsidies.

The idea that the UK subsidises fossil fuels is so daft that even the noble and learned Baroness Worthington has rejected it. Interestingly, the evidence on which this declaration was made seems to have been commissioned by the committee from Oxford Energy Associates, a loose affiliation of green-minded academics. No doubt you need some policy-based evidence making to build such a green fairy tale world.

But of course, when looked at through green goggles, real subsidies - those for renewables - are a different kettle of fish, being 'an essential lever':

Subsidies for renewables are an essential lever to provide certainty to industry and drive investment in those technologies. The Government should rethink its hostility to a separate continued European target for the deployment of renewables.

And, like the Labour party, they seem quite clear that energy bills are not yet high enough:

The variation in definitions of subsidy allows the Government to resist acknowledging subsidy in many areas, particularly on nuclear energy and the lower rate of VAT on domestic and small business bills.

Reader Comments (75)

I have some experience of a campaign where a passionate few organised and made big waves that reverberate even now, ten years later. AngusPangus and Don are right. Time to gird loins and set to.

If we could all stop wringing our hands and start taking the fight to these green crooks then I'm sure we would make an impact.

Dec 2, 2013 at 6:26 PM Don Keiller

I agree. If we are relentlessly nice to our political class, then they will see it the way they wish to see it: as deference.

And let's not forget the occasional "windfall tax" (and the armies of environmental consultants required as a result of burgeoning Green Tape. It's far less fanciful to call that a "tax" than with the so-called "subsidies" on fossil fuels)

As I've said before, you'll know Green Energy is finally viable when it gets hit with a Windfall Tax.

As charities are zero or reduced rate rated for VAT on energy supplies for the following:

http://www.hmrc.gov.uk/charities/vat/fuel-power.htm

As well as being tax exempt, claiming tax back on gift aid and getting 80% relief on business rates it certainly looks as though terrorist organisations like Greenpeace are subsidised to the hilt by the British taxpayer.

Actually, Mike (Dec 2, 2013 at 6:14 PM), I was being rhetorical. I am aware that there are many who believe that CO2 is a dangerous pollutant, so the idea of not being robbed blind is really an income will not be hard for folks like that to encompass.

A good start in 'being nasty to greens' would be to remove the charitable status from such overtly political organisations as Greenpeace, Fiends of the Earth, WWF etc.

Billy Liar

Now were talking. +1 for you sir.

Re: Mickey

I guess I'm being dense because VAT doesn't affect the business. If a business has a fuel bill of £100 + £5 VAT then they pay £105 but claim the £5 back from C&E. If the bill is £100 + £20 VAT then they claim the £20 back. Any VAT the business pays out is refunded and any they collect is paid to C&E. The only way VAT affects a business is they need an increased cash flow to cover the period between paying the VAT and getting it refunded by C&E.

As an example, Company A makes a widget and sells it for £100 + £20VAT to Company B. B sells it to C for £150 + £30VAT. C sells it to you for £200 + £40VAT.

At the end of the quarter:

A Pays the £20 VAT (received from B) to Customs and Excise.

B Pays £10 (£30 from C less the £20 they paid to A) to Customs and Excise.

C Pays £10 (£40 from you less £30 they paid to B) to Customs and Excise.

The end result is that Customs and Excise has the £40 in VAT that you paid and none of the companies have paid any VAT. This is true whether it is a widget or a kWh of electricity.

Re: Billy Liar

Greenpeace has split up its activities.

The charity is called Greenpeace Environmental Trust (charity number 284934) and has an annual income of £3.5 million, £2.4 million in the bank and £2.6 million in assets.

Greenpeace Limited (company number 01314381) isn't a charity and, I believe, might even have a few people in a Gulag somewhere, has an annual income of £10.5 million, £2.1 million in the bank and £3.4 million in assets.

Greenpeace UK Limited (company number 02463348) isn't a charity but is the parent company of Greenpeace Limited.

If it wasn't split into 2 then the activities of Greenpeace Limited would cause the other one to lose its charitable status.

The select committee does not define what it means by a "subsidy". I believe that by far the biggest source of "subsidy" of fossil fuels in the UK is the reduced rate of VAT on gas and electric. The committee should properly define what they are targeting here. The electorate would love to know that their representatives think that the VAT on their gas and electric bills should increase from 5% to 20%, adding £200 to the average domestic bill.

TerryS

http://www.hmrc.gov.uk/charities/tax/trading/subsidiary.htm

""Fossil fuel subsidy", they wheel that old canard out again."

Of course.

And they count road building and maintenance that is paid for by Govt funds as a "subsidy".

No doubt they also count any Govt job that includes car as a subsidy.

etc etc

Not hard to imagine all sorts of other such "subsidies", is it?

TerryS

I agree with what you're saying though technically for small companies you can't claim all the VAT back.

What I mean is if you are Company A and you sell fuel to customers at £100 part of that price includes VAT that you as the supplier must pay HMRC. It affects your bottom line. If the VAT is higher your profit margins may be tighter as driving up the price to compensate for increased Vat may become uneconomical.

And my other point was that as fuel is an essential why is there VAT on it at all. Seeing that as other posters have pointed out there are other levies and taxes on producers as well.

TerryS: A succinct summary of how VAT works. But when you see it spelt out, isn't it obvious what a daft system it is? and how it just generates paper and work for everybody? Thank you, EU.

Re: Micky

> What I mean is if you are Company A and you sell fuel to customers at £100 part of that price includes VAT

You are not selling it at £100, you are selling it at £95.24 + £4.76 VAT (5%). All of your profit margins are factored into the £95.24 and you are simply acting as a tax collector for the government with the £4.76

> technically for small companies you can't claim all the VAT back.

The threshold of £79k is extremely low. If 2 people (yourself and one other) work for the company then making enough to just cover the wages will put you over the threshold. Even a street vendor selling newspapers would qualify for VAT registration.

I've often thought that if you wanted to introduce a tax system on goods that was as complicated and bureaucratic as possible, VAT would be the answer.

Didn't we used to have a simple thing called 'purchase tax'?

It's probably easiest to see VAT as an end-user tax. The intermittent stages are simply revenue processing points.

Apart from certain defined activities within businesses (I've been out of the loop for a long time so I'm hazy on details but I seem to remember car usage was one of them) VAT is irrelevant to everyone except the final consumer of the product.

Unfortunately the home furnishing giants have been allowed to get away with "we pay your VAT" promotions which the ASA really ought to classify as misleading because they are just the sort of thing that misleads the public about what VAT is. In fact all they are doing is reducing the price by 16.67% (£120 becomes £100 at 20% rate) but what they pay in VAT is also reduced by 16.67% which means in this example their VAT bill is £16.67 (minus their inputs, of course).

While the figures may differ the principle applies right across the board. When eco-warriors talk of subsidies to energy companies they are making a deliberate attempt to sow confusion and — let's keep it simple, shall we — tell lies.

TerryS

Okay there's a bit of confusion here. First of all a consumer won't care if the actual price is 95.24. They still pay 100 and can't reclaim VAT

So Lets assume we are VAT registered. Company A sells at 105. So their profit is 100 plus any VAT they can reclaim. Not all the 5% goes to the VAT man.

As you say your other costs are factored into the 100 quid.

Now say the VAT should be 20%. Company A may have to still sell at £105 to be competitive but this means a basic profit of 87.5 not including VAT claimed back on sale.

So the increased VAT may mean lower profit if the market doesn't allow you to raise prices and they expect VAT to be inclusive.

That's all the point I was making in the end. The bit about not being VAT registered was just a thought.

> So Lets assume we are VAT registered. Company A sells at 105. So their profit is 100 plus any VAT they can reclaim. Not all the 5% goes to the VAT man.

All of the 5% goes to the VAT man. If the company retains any as profit then they (the directors) will end up in jail. All of your VAT is accounted for separately to any other money.

When VAT increases the increase will also affect your competitors. An increase from 5% to 20% on your products also occurs on your competitors products. Now you might decide to reduce your profit margin on the £100 so as to make your product more appealing than your competitors but that is a commercial decision that many companies make from time to time for many reasons (e.g. sales, 2 for 1 offers, 20% discounts etc).

Bottomline is a tax break a subsidy ?

It would be if total taxbreak was higher than tax paid in, putting your competitors at a disadvantage.

- farmer takes potatoes out of ground for free.. Sells and pays no taxes

- oil biz takes oil out of ground for free, pays massive tax to gov ' sometimes receives new field tiny tax break.. Not a subsidy.

- oil sold to public at 5% VAT - not a subsidy cos competing energies like wind/solar also 5% VAT

.. So lets talk about unfair subsidies the green mafia receive

TerryS

All your VAT doesn't go to the VAT man in all cases. The flat rate for example means you pay 13%. It's a work around as you can't reclaim VAT on purchases. For a large fuel company though yes all VAT goes to HMRC. That just leaves the impact VAT has on costing, your brand and business model. These may differ between competitors.

As for all prices going up, again it depends on how and where you source materials and how lean you are operationally. For example you may source from overseas or you may use local. All of these things tie into your brand and what a customer buys. So you may get away with charging higher prices, you may not. Similarly if VAT is larger you may not be able to run a profitable business.

The whole process of being unique to create your USP can have an affect on your bottom line. And hence VAT changes can mean you take a hit.

My main point was that fuel sales shouldn't be subject to VAT as its an essential item like bread which is VAT free. To say it is subsidised is not exactly correct as the Bishop I think is pointing out.

stewgreen

You're correct. You could argue that 5% VAT on fuel is a subsidy only if you accept that thick woolly sweaters are a viable alternative product. Since I haven't heard the knitwear industry making that claim (yet?!) I assume they accept they are not competitors to the electricity suppliers.

Now if gas carried a 5% levy and coal a 20% levy that would be different.

And your point about unfair subsidies to green energy is a valid one.

Also any argument about who pays for decommissioning costs for nuclear needs to be seen in the context of who is going to pay the decommissioning costs for wind turbines. If you think it will be the renewables industry then I have this bridge you might be interested in ...

The trouble with VAT (and Australia's GST) is that it makes businesses become employees of the tax collectors. They have to set up and maintain all these records through the supply chain for what is ultimately a consumption tax.

It strikes me as a way of obscuring what is going on. In the US, for example, you can get a bill which says $10 plus 7.7% State Tax = $10.77. No wonder credit cards took off there. Who has $10.77 at hand, and what retailer wants to deal with it?

Anyway, getting back to the main point:

(i) A reduction in tax is only a subsidy if you presuppose that all income belongs to the State; and

(ii) Given that the State does extract taxes, the question should be how equitable they are across various fields of endeavour. This goes double for grants. Picking favourites, as the Obama administration's deplorable record has shown, is just handing over taxpayers' money to people who P T Barnum would have tipped his hat to.

Heh. If only. Big projects like Australia's NW Shelf and Browse Basin can take ten or more years of investment in infrastructure (which is itself ten or more years after spending on exploration and assessment) and complying with red and green tape before they're even ready to to drill a development well, let alone produce oil or gas to sell.

In that time , the bottom can drop out of the market or any number of things can happen. That's why it's a huge risk requiring a huge reward as incentive. That reward is in the sale of the oil or gas, and not sought from the host government.

All the developers ask is that the governments requirements are predictable and understandable so they can plan around them, but that wish is seldom granted ...

Lord Beaverbrook hits nail on head: Oil Companies, huge net tax payers, are being attacked, judged and condemned by so-called NGO's which pay no operating taxes, exist by taking money from others, especially tax payers. NGO's are in effect parasites. At one time they were mostly benign. Lately it is clear they are no longer benign parasites, but are rather pernicious. These pernicious parasite NGO's are attacking the producers to concoct a rationale in favor of supporting unproductive businesses like wind mills and solar. Which only exist, as do NGO's by taking from society and actually add nothing. But the wind mills and solar energy schemes do profit the friends and cronies of the NGO's.