Bishop Hill

Bishop Hill Counting the cost

Nov 29, 2013

Nov 29, 2013  Energy: gas

Energy: gas  The theme of this morning seems to be shale gas, and what effect it's going to have on prices, and there is still a distinct lack of clarity about which shale plays are being discussed in relation to the European market.

The theme of this morning seems to be shale gas, and what effect it's going to have on prices, and there is still a distinct lack of clarity about which shale plays are being discussed in relation to the European market.

Lord Browne, former head of BP and now the chairman of Cuadrilla was offering up his views on the subject in London last night, saying that shale is not going to reduce prices in the UK. This is a view that we hear a lot, and seems to be based on the Poyry report that was discussed here a few weeks ago. However, as I understand it, this report looked at the effect of exploitation of the Bowland on UK gas price, concluding that because the UK is connected to mainland Europe by a number of gas pipelines the benefits of the gas would be shared with our European friends. Prices would therefore only be expected to fall by 4%.

Of course, as Tim Worstall noted at the time, a 4% benefit right across Europe is an awful lot of benefit, but to understand the effect of shale gas on the UK it would actually have made more sense to look at the effect of European shale on European gas prices. Fortunately that information was in another Poyry report which I mentioned here the other day, and which concludes that we could be looking at 11% price reductions.

Given that the government is betting the house on huge price rises, I think we need to look to our wallets.

In somewhat related news, Euan Mearns has picked up on a particularly vigorous comment thread here at BH and has been looking at the breakeven point for shale wells, concluding that it's currently somewhere above $4 per mmbtu, a figure that is well below current market prices in the UK. So there should be no shortage of people looking to exploit UK shale plays.

Bishop Hill

Bishop Hill

In related news, Welsh MPs have been told that there is a lot of gas under the principality too:

The MPs heard evidence from Gerwyn Williams, chairman of UK Onshore Gas Limited, whose subsidiary company Coastal Oil and Gas hold licences to explore 500,000 acres across south Wales and some areas in Somerset and Kent.

Rather than extracting, his company is currently focusing on exploring for shale gas and coal bed methane, and Mr Williams said the results of initial tests were encouraging.

"There is an enormous amount of gas in south Wales and I've spent my life in the mining industry - 22 years for British Coal and then in private mines, and they've virtually all gone," he said.

Reader Comments (63)

Bruce, on the off chance that you have not read my post that Andrew links to:

"Pre 2008 financial crash, there were roughly 400 rigs drilling oil in the USA and 1600 drilling gas. Today it is roughly 1400 drilling oil and 400 drilling gas"

What is the real cost of shale gas?

Its no surprise that the rig balance is leaning towards more lucrative oil and gas liquids instead of dry gas.

Oil was 40$ after the crash and is now 100$.

The "cheaper price" is a bit of a red herring.

The things that matter are:-

1) We reduce our reliance on offshore supplies.

2) We help the balance of payments.

3) We provide useful jobs and local revenue.

4) We generate tax revenue.

If we can get all that at the same price as imported gas, I think we have a bargain.

True, Paul H. And you can add:

5) We increase competition and diversity in the energy market.

Bruce

Took the words from my keyboard. Isn't it just market forces at work, as price of gas rises against oil rigs will move back again or Euan's rigs will be built

SandyS, yes it is good to be skeptical of models. But at least climate models have a basis in physics. What is the basis of an economic model that runs for 37 years? I don't think the Bishop or some of those here realize just how ridiculous predicting 11% (not 10% mind you!) cheaper in 37 years really is.

Chandra, there is real data on shale oil/gas formations. The real data is amazing. As someone wrote earlier this year:

"Two years ago in June 2011 Bentek forecast that crude production in the Williston Basin would grow to 900 Mb/d by 2016. Today’s production in North Dakota and Montana is already at that level. What we are learning about US shale production is that it has been growing at twice the rate of every forecast out there."

The real data on climate is that the models are bad at predicting the future.

Paul Homewood (and joanna)

Many thanks for that piece of clarity.

Obviously cheaper prices for gas would be a pleasant outcome but cheaper in relation to what? A question rarely asked by the economic semi-literates.

Anything which increases the supply (and the competition and diversity) has the potential to bring prices down in real terms which is what matters. Self-sufficiency or an approach to it saves money in other related areas (shipping costs, Putin suddenly having a strunt because we've done something he doesn't like, unreliability of supply in a volatile market, and so on). Most importantly the opportunity for tax revenue which, intelligently handled, can provide long-term benefits in terms of increased wealth directly and/or reduced taxation in other areas leading to further benefits.

Added to which if the prospecting and development is in the hands of private enterprise there is no public economic downside since no public money is at risk.

The only necessary condition is that the regulatory and fiscal regimes need to be such as to encourage investment while not causing unacceptable side effects either socially or environmentally.

Grow a pair, Cameron, and get on with it!!

I have not heard one convincing argument that should prevent private, unsubsidised, investment in shale gas. Lots of sophistry by supporters of 'renewables' desperate to prevent their precious little folly being ousted by shale gas but no convincing arguments.

If it fails, so what? 'Renewables' have been failing for years but still the government insists on pouring money into a bottomless pit.

'But at least climate models have a basis in physics.' Santa Clause has a basis in the reality of reindeer and sleighbells.

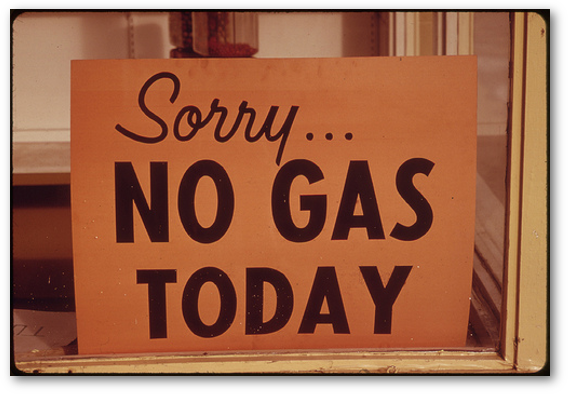

@ Paul, I concur. "Expensive" gas is much better than "sorry no gas today". And expensive may still mean cheaper electricity than we have today (at today's prices) if the Green shackles are dumped.

Steel pipe benefits:

"YOUNGSTOWN, Ohio – Vallourec Star this morning will dedicate its new $1.05 billion seamless pipe mill, one of the most heralded economic development projects in the Mahoning Valley’s history.

Vallourec executives Joel Mastervich, Skip Herald and Philippe Crouzet are slated to be on hand for this morning’s events, which will include a news conference, tour of the state-of-the-art mill and dedication ceremony. The mill, first announced in February 2010, was built to manufacture small-diameter oil country tubular goods, or OCTG, pipe and connections for the oil and gas market. Other products manufactured at the mill include line pipe, green pipe for drill pipe and coupling stock."

http://businessjournaldaily.com/company-news/vallourec-star-dedicate-650m-mill-today-2013-6-12

Chandra, look at real data. Since 09 UK gas and US gas prices have diverged and are now 6$/Mmbtu. That real data.

As North Sea gas runs out, without shale gas, the UK may have to pay closer to Japans $16/Mmbtu.

http://www.bp.com/en/global/corporate/about-bp/statistical-review-of-world-energy-2013/review-by-energy-type/natural-gas/natural-gas-prices.html