Bishop Hill

Bishop Hill More evidence that nobody believes in climate policy

May 2, 2013

May 2, 2013  Climate: Parliament

Climate: Parliament  Energy: grid

Energy: grid  Energy: targets

Energy: targets The Economist notes that far from pulling back from the oil and gas business, governments - allegedly concerned with climate targets - are actually expanding their fossil fuel businesses and that exploration activity is expanding across the board:

Such behaviour, on the face of it, makes no sense. One possible explanation is that companies are betting that government climate policies will fail; they will be able to burn all their reserves, including new ones, after all. This implies that global temperatures would either soar past the 2°C mark, or be restrained by a technological fix, such as carbon capture and storage, or geo-engineering.

Recent events make such a bet seem rational. On April 16th the European Parliament voted against attempts to shore up Europe’s emissions trading system against collapse. The system is the EU’s flagship environmental policy and the world’s largest carbon market.

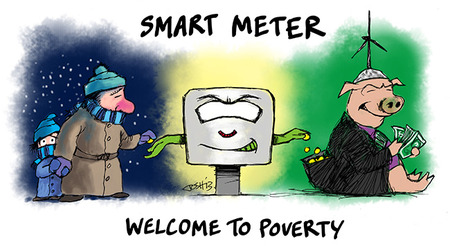

Putting it at risk suggests that Europeans have lost their will to endure short-term pain for long-term environmental gain. Nor is this the only such sign. Several cash-strapped EU countries are cutting subsidies for renewable energy. And governments around the world have failed to make progress towards a new global climate-change treaty. Betting against tough climate policies seems almost prudent.